Penalty For Drawing From Ira

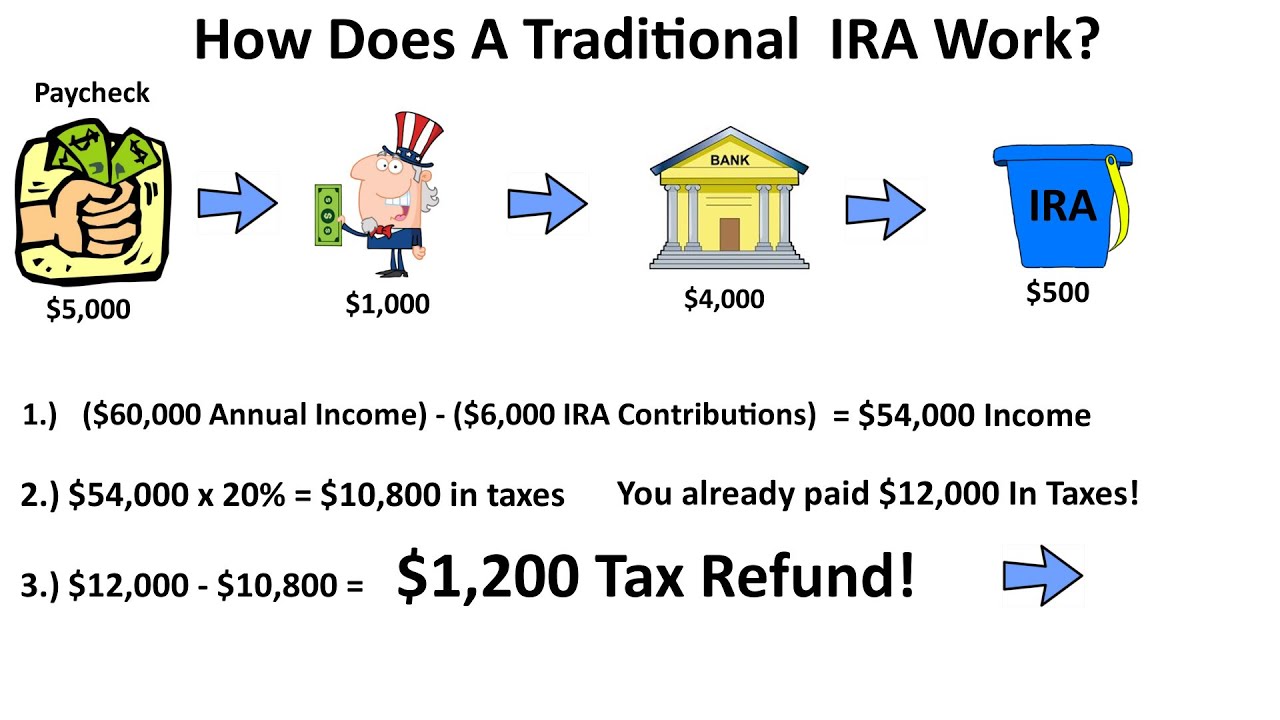

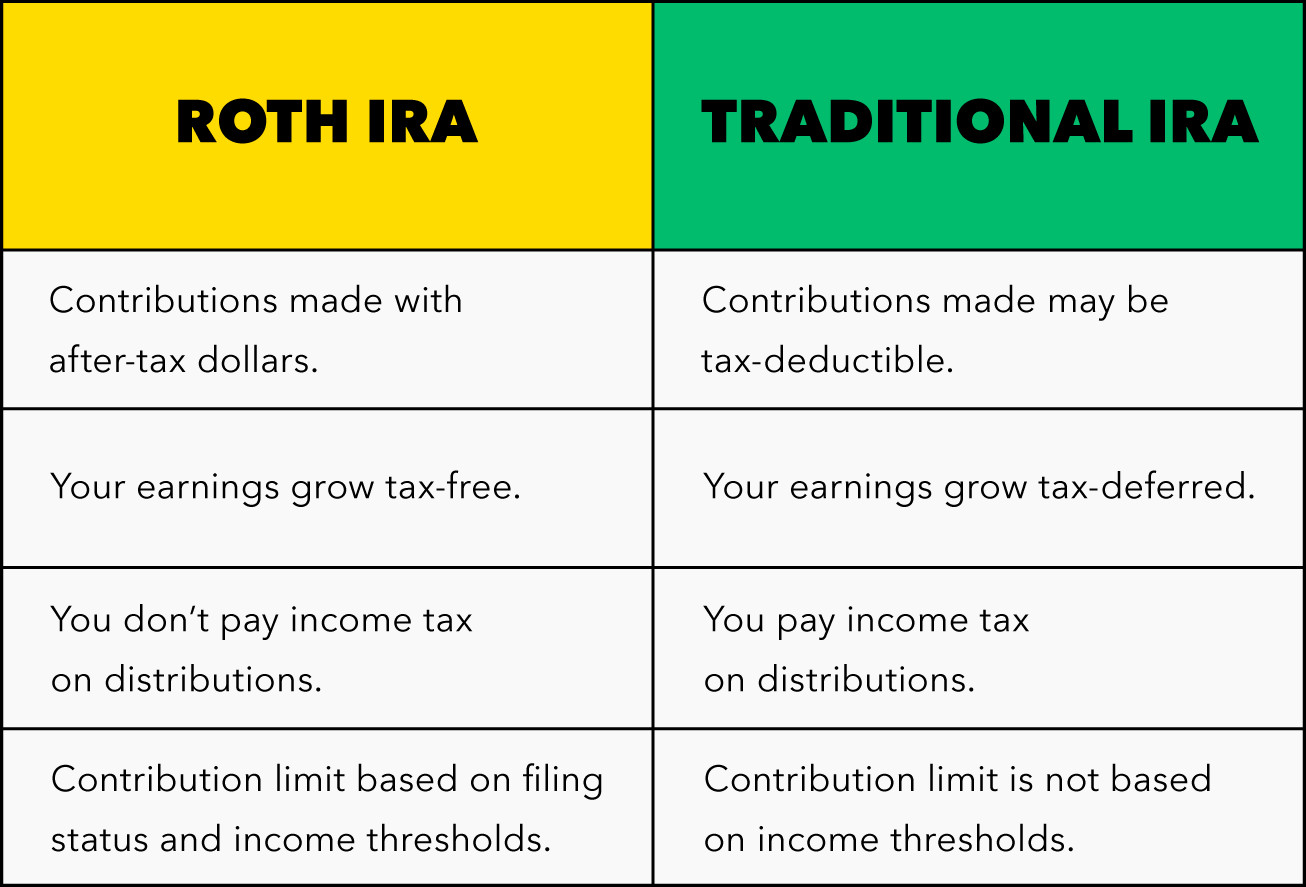

Penalty For Drawing From Ira - It’s important to understand the traditional ira and. Web sometimes the answer is zero—you owe no taxes. You can even owe an additional penalty if you withdraw funds. Web these distributions may be subject to income taxes and a 10% penalty, depending on your age and how long you've held the account. Learn more from our partner. Web the irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2020. Learn more from our partner. The ira owner passes away. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. There may also be a 10% tax penalty. Web rmds are taxable income and may be subject to penalities if not timely taken. While tapping your ira might get you. A higher 25% penalty may apply if. But it's still critical to know how your withdrawal may be taxed. Save on taxeswide array of investmentslow or no fees Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year. Western alliance bank high yield cd. “sometimes that’s how you have to shut a game down, a little dirty. Web retirement topics — required minimum distributions (rmds) | internal revenue service. The ira owner passes away. Web july 21, 2023, at 9:21 a.m. The ira owner passes away. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. In many cases, you'll have to pay federal and state taxes on your early withdrawal. Will i have to pay the 10% additional tax. Government charges a 10% penalty on early withdrawals from a traditional ira, and a state tax penalty may also apply. Web the irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2020. Retirement planningget retirement readyexceptional service1:1 investment advice Web what if i withdraw money from my ira? But it's still critical to know. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. There are exceptions to the 10 percent penalty. It’s important to understand the traditional ira and. As mentioned previously, required minimum distributions take effect only later in. Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year. Fund comparison tooldigital investing programlow cost fundsretirement calculator Retirement planningget retirement readyexceptional service1:1 investment advice If you withdraw investment earnings before 59 ½. Web are you over age 59 ½ and want to withdraw? Government charges a 10% penalty on early withdrawals from a traditional ira, and a state tax penalty may also apply. There may also be a 10% tax penalty. You won't be responsible for taking money out of your ira until you turn 72. “sometimes that’s how you have to shut a game down, a little dirty. A higher 25% penalty may apply if. You can even owe an additional penalty if you withdraw funds. The ira owner passes away. Web july 21, 2023, at 9:21 a.m. Retirement planningget retirement readyexceptional service1:1 investment advice While tapping your ira might get you. You won't be responsible for taking money out of your ira until you turn 72. Web what if i withdraw money from my ira? You won't be responsible for taking money out of your ira until you turn 72. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Learn more from our partner. Web yes, there may be a 10% penalty if you withdraw money early from your roth ira, but only. Government charges a 10% penalty on early withdrawals from a traditional ira, and a state tax penalty may also apply. Web july 21, 2023, at 9:21 a.m. Web retirement topics — required minimum distributions (rmds) | internal revenue service. Rbmax high yield savings account. There are exceptions to the 10 percent penalty. Web no, the additional 10% tax on early distributions from qualified retirement plans does not qualify as a penalty for withdrawal of savings. In other cases, you owe income tax on the money you withdraw. Web sometimes the answer is zero—you owe no taxes. Web these distributions may be subject to income taxes and a 10% penalty, depending on your age and how long you've held the account. Government charges a 10% penalty on early withdrawals from a traditional ira, and a state tax penalty may also apply. Fund comparison tooldigital investing programlow cost fundsretirement calculator As mentioned previously, required minimum distributions take effect only later in. Web are you over age 59 ½ and want to withdraw? Web retirement topics — required minimum distributions (rmds) | internal revenue service. Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. It may not be a good thing for heirs, experts say. Save on taxeswide array of investmentslow or no fees Will i have to pay the 10% additional tax. Withdrawals must be taken after age 59½. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty.

tax deferral explained Inflation Protection

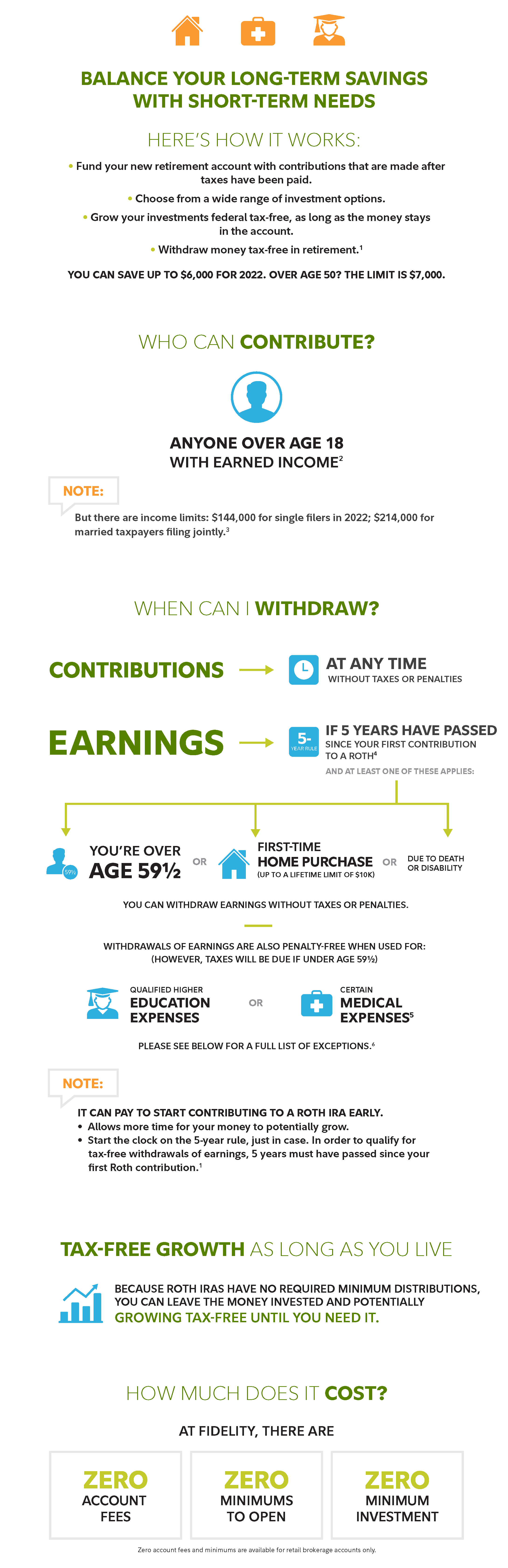

Roth IRA Withdrawal Rules and Penalties First Finance News

Roth ira penalty calculator DeanaBrooke

What is an IRA Withdrawal and How Does it Work? Hanover Mortgages

Roth IRA Early Withdrawals When to Withdraw + Potential Penalties

11Step Guide To IRA Distributions

Roth IRA Withdrawal Rules and Penalties The TurboTax Blog

The Lange Report April 2020 Pay Taxes Later

Early Withdrawal Penalty Guide 401k and IRA Penalties Calculator

Roth IRA Penalties How to Fix Excess Contributions YouTube

You Won't Be Responsible For Taking Money Out Of Your Ira Until You Turn 72.

You Cannot Keep Retirement Funds In Your Account Indefinitely.

Generally, Early Withdrawal From An Individual Retirement Account (Ira) Prior To Age.

Web What If I Withdraw Money From My Ira?

Related Post: