When Can I Draw On My 401K

When Can I Draw On My 401K - You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web what is the rule of 55? In most, but not all, circumstances, this triggers an early withdrawal penalty. Come retirement, though, your withdrawals are subject to income taxes and other rules. Web april 13, 2022, at 5:34 p.m. Under the terms of this rule, you can withdraw funds from your current job’s 401 (k) or 403 (b) plan with no 10% tax penalty if you leave that job in or after the year you turn 55. With traditional 401 (k) plans, employers can make contributions to all participants, match employee contributions, or both. Unlike a 401 (k) loan, the funds need not be repaid. You can't take loans from old 401(k) accounts. Some employers will also match some of your contributions, which means “free money” for you. 23, investment professionals who offer services as trusted advisers. Some reasons for taking an early 401 (k). Web if you reach age 72 in 2023, the required beginning date for your first rmd is april 1, 2025, for 2024. If your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Some employers will also match some of your contributions, which means. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. (these are called required minimum distributions, or rmds). Come retirement, though, your withdrawals are subject to income taxes and other rules. That’s because withdrawals from a 401 (k) taken before age 59.5 usually are subject to a 10% penalty in addition to. Web understanding early withdrawals. With the rule of 55, those who leave a job in the year they turn 55 or later can remove funds from that employer’s 401 (k) or 403 (b) without having to. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Web you can make. If you retire after age 59½, you can start taking withdrawals without paying an early withdrawal penalty. If that happens, you might need to begin taking distributions from your 401 (k). Web understanding early withdrawals. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. Web the required beginning date is april. Some employers will also match some of your contributions, which means “free money” for you. Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. This is where the rule of 55 comes in. A 401(k) account alone may not help. You’ll simply need to contact your plan administrator or log into your account online and request a withdrawal. If you don’t need to access your savings just yet, you can let them. Web americans will get new protections for the trillions of dollars that moved out of their 401 (k)s and into individual retirement accounts, under labor department regulations released. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. Contributions and earnings in a roth 401 (k) can be withdrawn without. Web understanding early withdrawals. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Anyone eligible can contribute to an. Web if you reach age 72 in 2023, the required beginning date for your first rmd is april 1, 2025, for 2024. But you must pay taxes on the amount. They also can use a vesting schedule and. (qualified public safety workers can start even earlier, at 50.) it doesn’t matter whether you were laid off, fired, or just quit.. If your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Fact checked by kirsten rohrs schmitt. Web you can make a 401 (k) withdrawal at any age, but. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. Web a withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Anyone eligible can contribute to an employer's 401 (k), but income limits apply to roth iras. You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. Web traditional 401 (k) plans: Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Web understanding early withdrawals. Web april 13, 2022, at 5:34 p.m. (these are called required minimum distributions, or rmds). If you retire after age 59½, you can start taking withdrawals without paying an early withdrawal penalty. Here's how those savings could grow, assuming you averaged. Web a 401 (k) plan can be a powerful help to retirement savers, but they work best if you don’t plan to stop working much before traditional retirement age. Contributions and earnings in a roth 401 (k) can be withdrawn without. A 401(k) account alone may not help you save as much as you need for retirement.; If that happens, you might need to begin taking distributions from your 401 (k).

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

How Much Should I Have in My 401k During My 20's, 30's, 40's and 50's

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

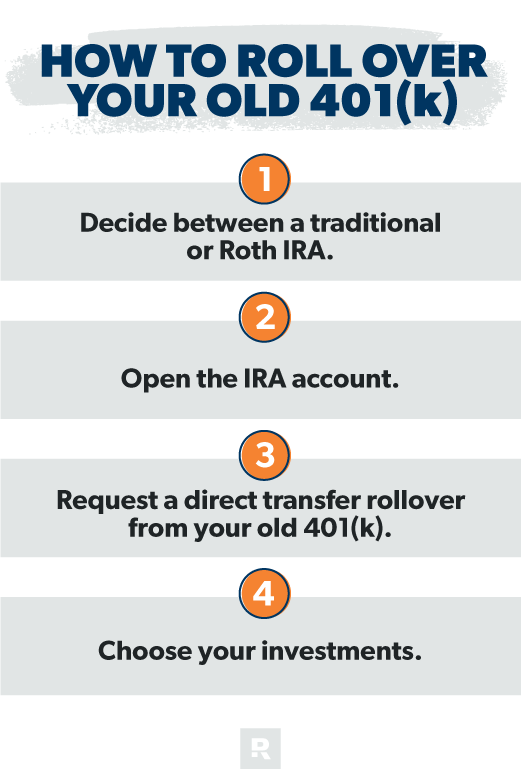

How to Roll Over Your Old 401(k) Ramsey

How to Set Up a 401k Plan for Your Business Benchmark my 401k

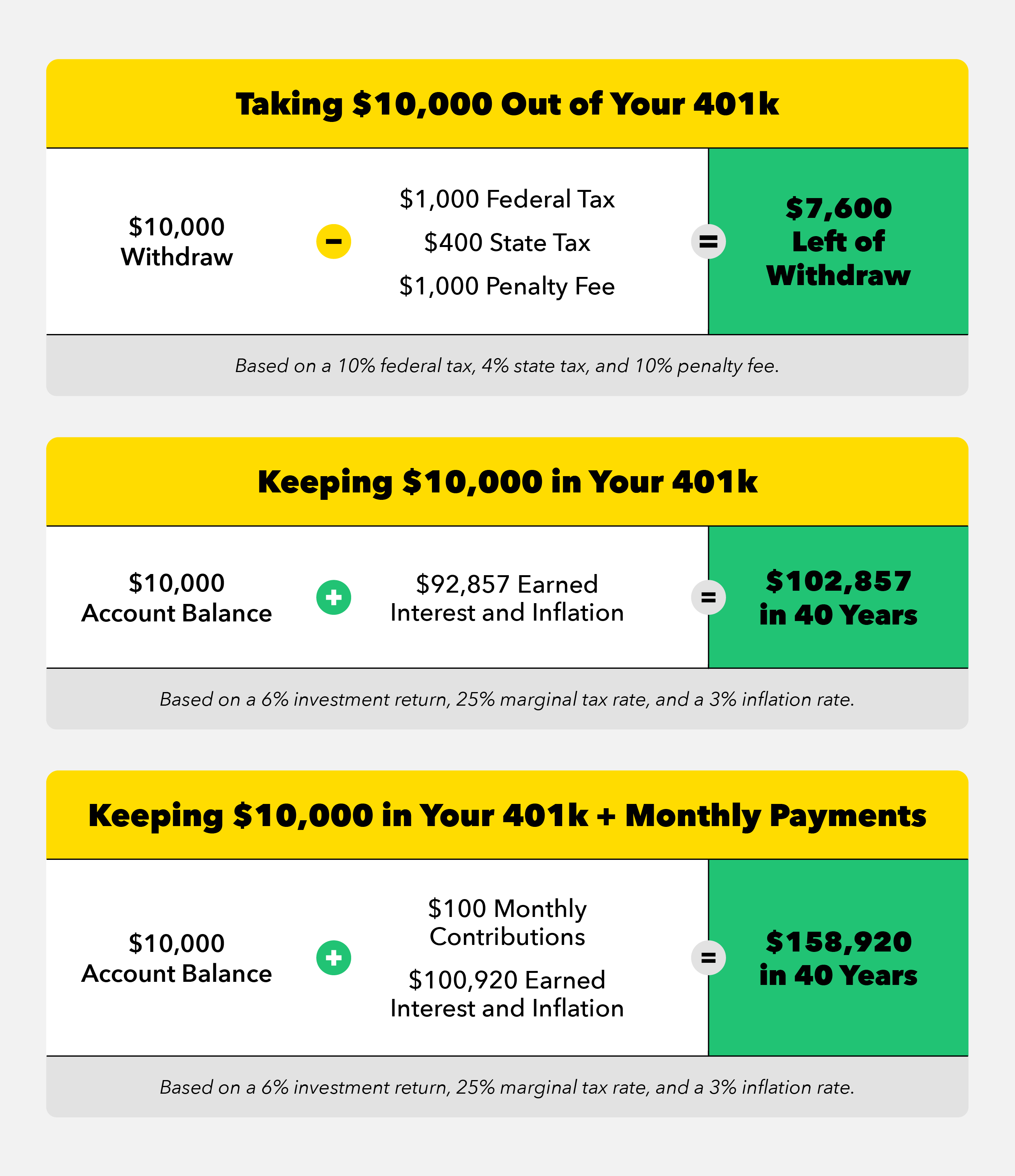

Should I Cash Out My 401k to Pay Off Debt?

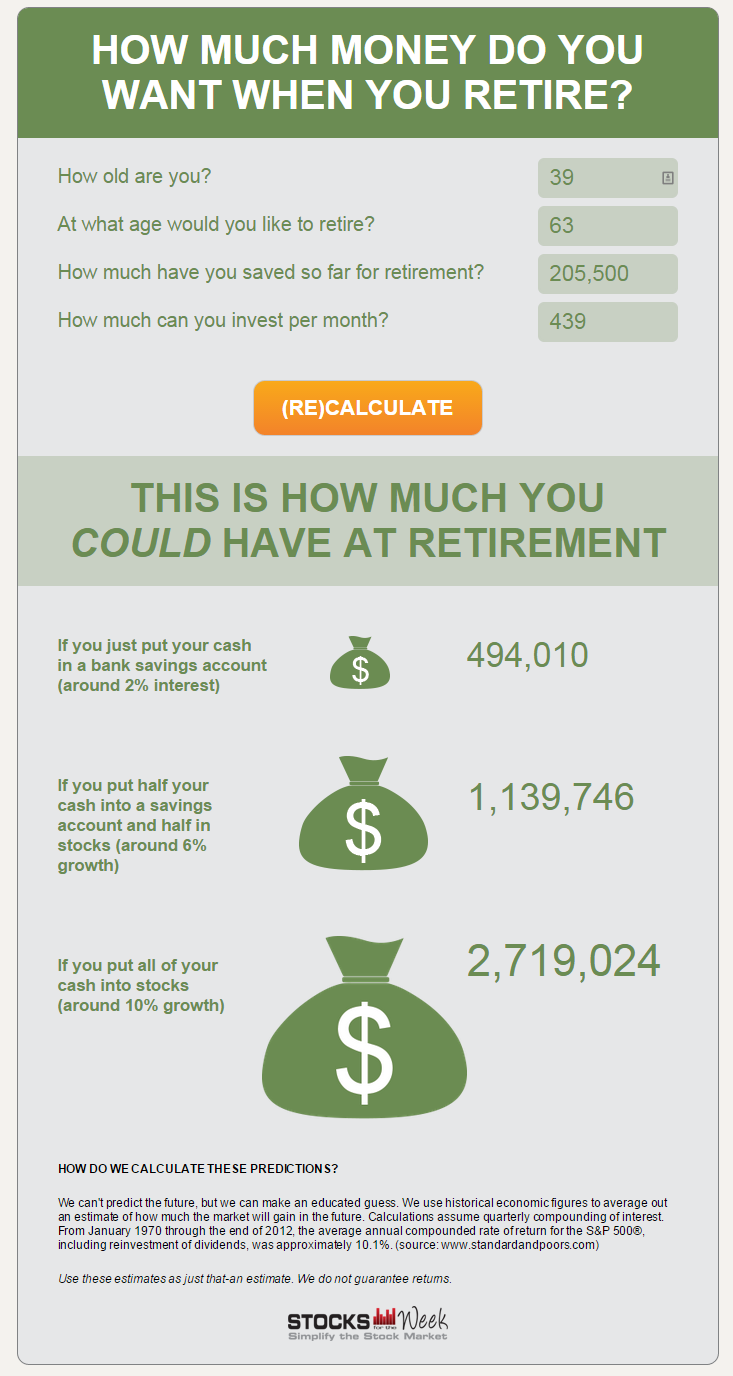

How to Estimate How Much Your 401k will be Worth at Retirement

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

When Can I Draw From My 401k Men's Complete Life

401k Savings By Age How Much Should You Save For Retirement

Web You Generally Must Start Taking Withdrawals From Your 401 (K) By Age 73 But Can Avoid This Requirement If You’re Still Working.

23, Investment Professionals Who Offer Services As Trusted Advisers Will Be Required To Act As Fiduciaries — That Is, They’d Be Held To The Highest Standard, Across The.

If Your Employer Allows It, It’s Possible To Get Money Out Of A 401 (K) Plan Before Age 59½.

Web If You Reach Age 72 In 2023, The Required Beginning Date For Your First Rmd Is April 1, 2025, For 2024.

Related Post: