What Is The Penalty For Drawing Out 401K Early

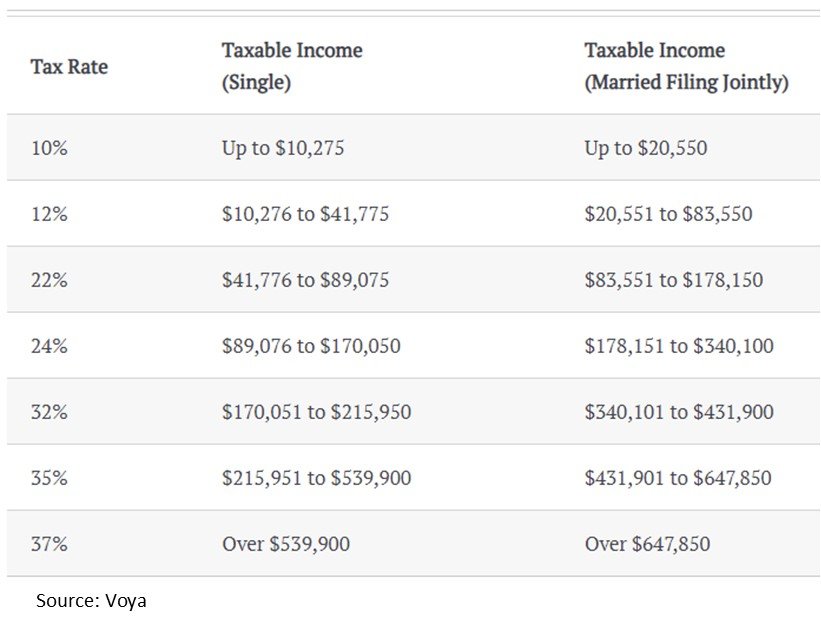

What Is The Penalty For Drawing Out 401K Early - For example, if you withdraw $20,000, a penalty of. Web you’ll also have to pay a 10% penalty on the amount withdrawn if you're under the age of 59½. Web the penalty for early distributions from 401(k)s is generally 10%, in addition to income taxes you’ll owe. Web should you withdraw money from a 401 (k) early? You generally must start taking. While there are typically penalties. Generally speaking, the only penalty assessed on. However, bear in mind that individual. 160 years strongcontinuous learningretirement productshighest service standards Gili benita for the new york times. Web all 401 (k) withdrawals from pretax accounts are subject to income tax, and an early withdrawal may also be subject to a 10% penalty. Web when a 401 (k) account holder withdraws money from a 401 (k) before age 59½, the irs may charge a 10% penalty in addition to the ordinary income taxes assessed on the. You may. In some cases, it's possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your. Unlock your 401(k) & iraonly takes 5 minutes.100% online Web updated on february 15, 2024. Edited by jeff white, cepf®. There are several ways to avoid the 401(k) early withdrawal penalty. Web here's what happens if you withdraw money from your 401 (k) account early: In some cases, it's possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your. Web the penalty for early distributions from 401(k)s is generally 10%, in addition to income taxes you’ll owe. Written by javier simon, cepf®. For example, if you. Web if you took an early withdrawal of $10,000 from your 401 (k) account, the irs could assess a 10% penalty on the withdrawal if it’s not covered by any of the exceptions outlined. Web the irs charges a 10% penalty on early 401 (k) withdrawals. Unlock your 401(k) & iraonly takes 5 minutes.100% online Web unless you’re 59 1/2. Web the only exceptions apply to a small number of situations that the irs exempts from the penalty tax, which is 10%. Web the irs charges a 10% penalty on early 401 (k) withdrawals. Web when a 401 (k) account holder withdraws money from a 401 (k) before age 59½, the irs may charge a 10% penalty in addition to. In some cases, it's possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your. While there are typically penalties. Web should you withdraw money from a 401 (k) early? Early withdrawals are typically taxed as income and may be subject to a 10% penalty. Web the only exceptions apply to a small number of situations. 160 years strongcontinuous learningretirement productshighest service standards You could trigger a higher tax bill. Written by javier simon, cepf®. Web the penalty for early distributions from 401(k)s is generally 10%, in addition to income taxes you’ll owe. 160 years strongcontinuous learningretirement productshighest service standards Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a. For example, if you withdraw $20,000, a penalty of. There are several ways to avoid the 401(k) early withdrawal penalty. Most 401 (k). Web the penalty for early distributions from 401(k)s is generally 10%, in addition to income taxes you’ll owe. However, bear in mind that individual. For example, if you withdraw $20,000, a penalty of. Unlock your 401(k) & iraonly takes 5 minutes.100% online Early withdrawals are typically taxed as income and may be subject to a 10% penalty. There are several ways to avoid the 401(k) early withdrawal penalty. Web early withdrawals from a 401 (k) often incur a 10% early withdrawal penalty if you're under 59 1/2. Most 401 (k) plans allow workers to withdraw money early. For example, if you withdraw $20,000, a penalty of. Your request might be denied. Once you reach age 59.5, you may withdraw money from your 401 (k) penalty. While there are typically penalties. Web when a 401 (k) account holder withdraws money from a 401 (k) before age 59½, the irs may charge a 10% penalty in addition to the ordinary income taxes assessed on the. Your request might be denied. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web you’ll also have to pay a 10% penalty on the amount withdrawn if you're under the age of 59½. There is a 10% penalty for pulling money from your 401(k) before age 59½ (with some exceptions), which can significantly eat away at your savings. Gili benita for the new york times. This means if you withdraw $10,000, your penalty would be $1,000. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a. You could trigger a higher tax bill. In some cases, it's possible to withdraw from retirement accounts like 401 (k)s and individual retirement accounts before your. Web the standard penalty is 10% of the withdrawn amount. Web all 401 (k) withdrawals from pretax accounts are subject to income tax, and an early withdrawal may also be subject to a 10% penalty. Web should you withdraw money from a 401 (k) early? Generally speaking, the only penalty assessed on.

Calculating 401k Early Withdrawal Penalties Understanding the

Early Withdrawal Penalty Guide 401k and IRA Penalties Calculator

What Is The Penalty For Early 401k Withdrawal FinancePart

What is the penalty to withdraw money from 401k early? A lot.

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

401k Early Withdrawal What to Know Before You Cash Out MintLife Blog

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

Early Withdrawal Penalty Guide 401k and IRA Penalties Calculator

401(K) Cash Distributions Understanding The Taxes & Penalties

Edited By Jeff White, Cepf®.

Web The Irs Charges A 10% Penalty On Early 401 (K) Withdrawals.

160 Years Strongcontinuous Learningretirement Productshighest Service Standards

Web If You’re Thinking Of Retiring — Especially If You’re Considering Retiring Early — It’s Important To Understand The 401 (K) Withdrawal Rules And How To Avoid Paying A 401 (K) Early.

Related Post: