What Age Can You Draw 401K Without Penalty

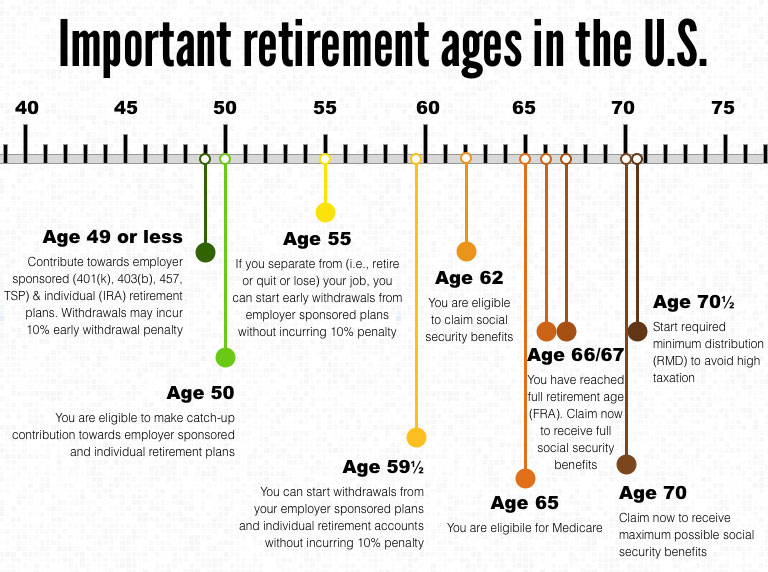

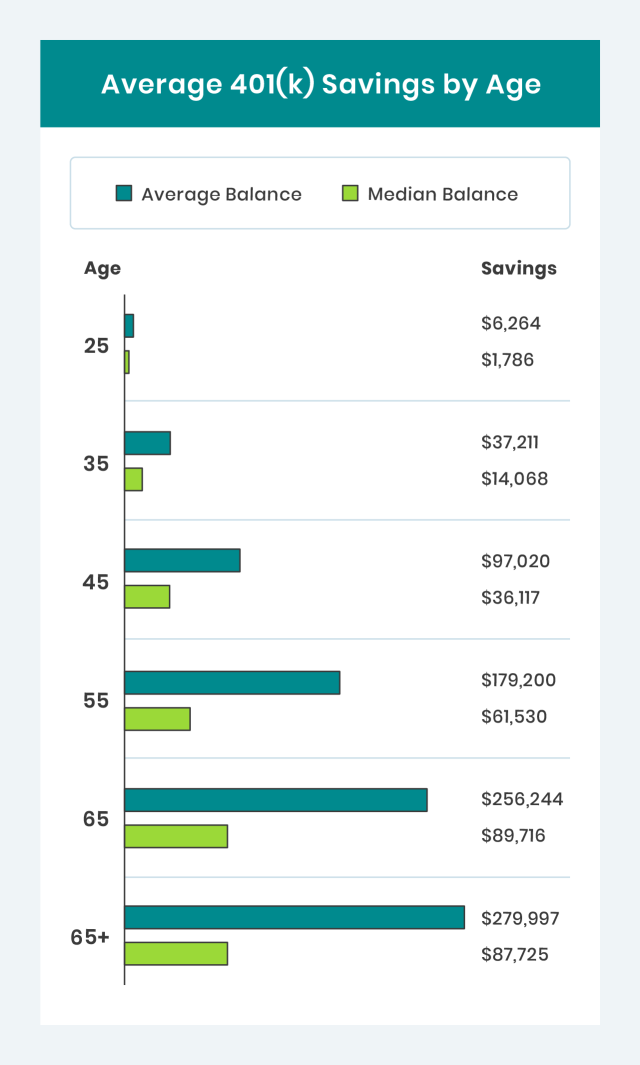

What Age Can You Draw 401K Without Penalty - If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). You can also push for change. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. There are some caveats to this age restriction. Turn 65 (or the plan’s normal retirement age, if earlier); The internal revenue service (irs) has set the standard retirement. However, you can apply the irs rule of 55 if you're older and leave your job. Web if your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Web taking an early withdrawal from a 401 (k) retirement account before age 59½ could have steep financial penalties. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Web if your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Terminate service with the employer. Retiring or taking a pension before 59 1/2. Web as a general. Web what is a 401 (k) and ira withdrawal penalty? You can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Taking that route is not always advisable, though, as early withdrawals deplete retirement savings. If you take a distribution from. Sometimes those consequences might be worth it—and they may even be entirely. Anyone eligible can contribute to an employer's 401 (k), but income limits apply to roth iras. The costs of early 401 (k) withdrawals. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Web however,. Web if you provide adequate proof, you can withdraw the funds without the early withdrawal penalty. Since both accounts have annual contribution limits and potentially different tax benefits. Generally, if you withdraw money from a 401 (k) before the plan’s normal retirement age or from an ira before turning 59 ½, you’ll pay an additional. Complete 10 years of plan. Web you can withdraw money penalty free from your 401(k) at age 59½, or even earlier for some qualifying purposes. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. The good news is that there’s a way to take your distributions a few years early without incurring this. (these are called required minimum distributions, or rmds). Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. Web if your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Web washington — the internal revenue service today reminded those who were born in. This rule applies whether it is voluntary termination or not. Since both accounts have annual contribution limits and potentially different tax benefits. This is known as the rule of 55. Web washington — the internal revenue service today reminded those who were born in 1950 or earlier that funds in their retirement plans and individual retirement arrangements face important upcoming. Web however, the irs has established the rule of 55, which allows those who leave a job in the year they turn 55 or later to remove funds from that employer’s 401 (k) or 403 (b) without having to pay. When can a retirement plan distribute benefits? Understanding the rules about roth 401 (k) accounts can keep you from losing. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: If you tap into it beforehand, you may face a 10% penalty tax on the. Web if your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. If you qualify for a hardship withdrawal, certain immediate. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Terminate service with the employer. The good news is that. Contributions and earnings in a roth 401 (k) can be withdrawn. With a 401 (k) loan, you borrow money from your retirement savings account. Web however, the irs has established the rule of 55, which allows those who leave a job in the year they turn 55 or later to remove funds from that employer’s 401 (k) or 403 (b) without having to pay. Web however, except in special cases you can’t withdraw from your 401 (k) before age 59.5 even then you’ll usually pay a 10% penalty. There are some exceptions to these rules for 401 (k) plans and other qualified plans. Accessing your 401 (k) funds before retirement age can turn costly due to taxes and penalties. There are some caveats to this age restriction. Web here’s how it works: Taking that route is not always advisable, though, as early withdrawals deplete retirement savings. If you’re contemplating early retirement, you should know how the rule of 55 works. Since both accounts have annual contribution limits and potentially different tax benefits. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. However, you can apply the irs rule of 55 if you're older and leave your job. If you need funds, you may be able to tap into your 401 (k) funds without penalty, even if you're under 59½. The internal revenue service (irs) has set the standard retirement.:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

401k Savings By Age How Much Should You Save For Retirement

What is the Average 401k Balance by Age? (See How You Compare) Dollar

The Rise Of 401k Millionaires Living Large In Retirement

401k By Age Are You Saving Enough For Retirement?

at what age do you have to take minimum distribution from a 401k Hoag

The Maximum 401(k) Contribution Limit For 2021

Important ages for retirement savings, benefits and withdrawals 401k

Average 401(k) Balance by Age Your Retirement Timeline

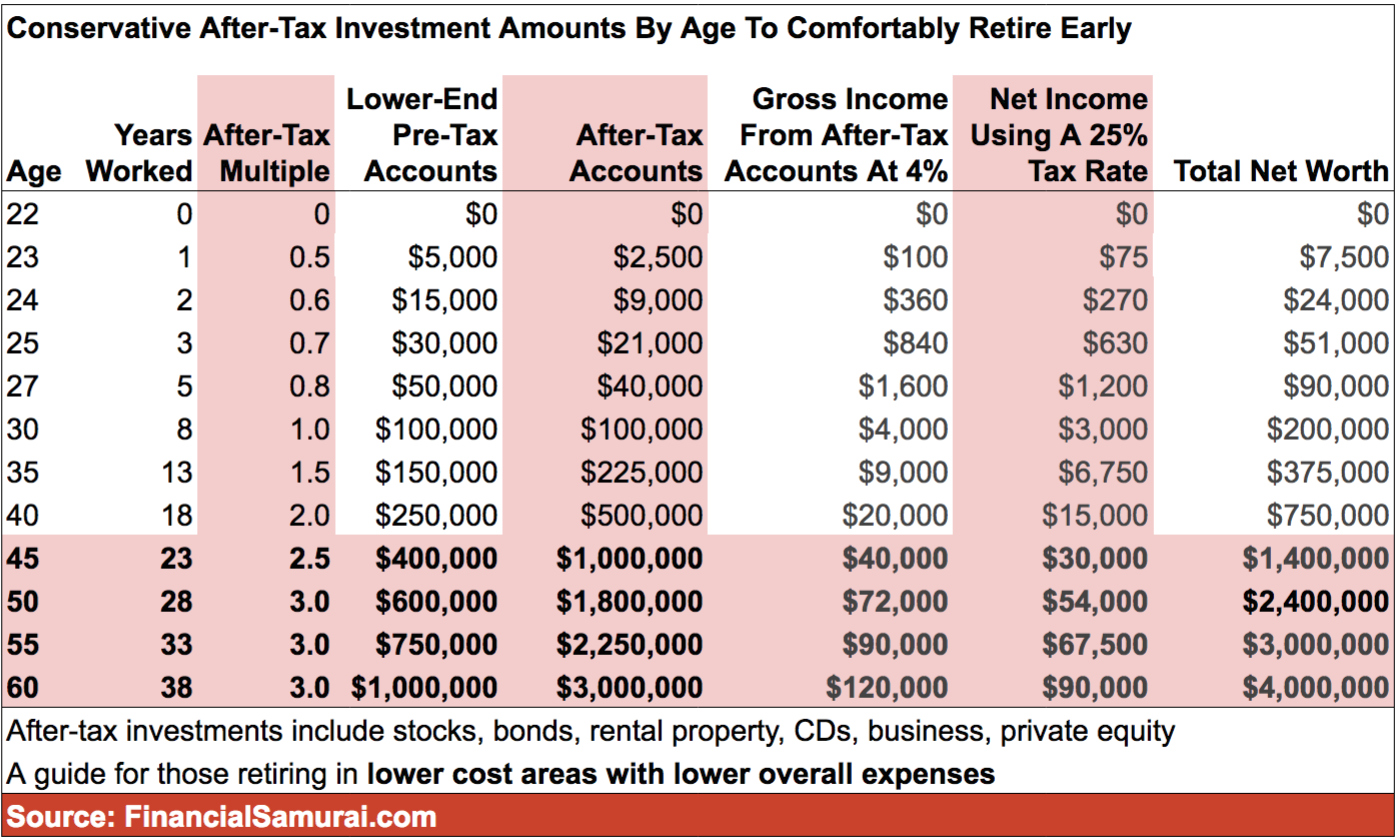

401k By Age PreTax Savings Goals For Retirement Financial Samurai

You Can Contribute To A Roth Ira (A Type Of Individual Retirement Plan) And A 401 (K) (A Workplace Retirement Plan) At The Same Time.

When Can A Retirement Plan Distribute Benefits?

Unless You Elect Otherwise, Benefits Under A Qualified Plan Must Begin Within 60 Days After The Close Of The Latest Plan Year In Which You:

Web You Generally Must Start Taking Withdrawals From Your 401 (K) By Age 73 But Can Avoid This Requirement If You’re Still Working.

Related Post: