How To Draw From 401K Early

How To Draw From 401K Early - Web the 401 (k) early withdrawal penalty is typically 10% of the amount of your distribution, so you can calculate your tax penalty by multiplying the amount you’re planning to withdraw by 0.1. Web use the 401 (k) early withdrawal calculator to how much you could be giving up by withdrawing funds early. Web taking an early withdrawal from your 401(k) or ira has serious consequences. Web as an example, if you are in the 24% tax bracket and you withdraw funds from your 401(k) early, you should expect to owe approximately 34% — 24% tax bracket plus 10% penalty — on the. Web 401 (k) or other qualified employer sponsored retirement plan (qrp) early distribution costs calculator. Projected account loss with withdrawal. They sport hefty contribution limits. Web distributions begin at age 59 ½. Get any financial question answered. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe regular. For 2024, you can’t put more than $7,000 into a roth, plus another $1,000 if you’re older than 50. Web and for some people, saving for retirement solely in a 401 (k) could make sense. A 401 (k) loan or an early withdrawal? The internal revenue service (irs) has set the standard retirement. But you may want to consider the. Early withdrawals from a 401 (k) often. Web the 401 (k) early withdrawal penalty is typically 10% of the amount of your distribution, so you can calculate your tax penalty by multiplying the amount you’re planning to withdraw by 0.1. Withdrawal amount after taxes and fees. Cashing out or taking a loan on your 401 (k) are two viable options. Web advantages of 401 (k) accounts: A 401 (k) loan or an early withdrawal? Web taking an early withdrawal from a 401(k) retirement account before age 59½ could have steep financial penalties. Web updated on february 15, 2024. 7, 2024, at 1:15 p.m. Web use the 401 (k) early withdrawal calculator to how much you could be giving up by withdrawing funds early. If you withdraw your 401 (k) money before age 59½, you. Edited by jeff white, cepf®. Updated on september 08, 2023. Get any financial question answered. Web most 401(k) plans allow workers to withdraw money early. Web distributions begin at age 59 ½. 401 (k) loans and certain hardship withdrawals will not be penalized. They sport hefty contribution limits. Estimate your expected expenses after retirement. Web most 401(k) plans allow workers to withdraw money early. Web taking an early withdrawal from a 401(k) retirement account before age 59½ could have steep financial penalties. Updated on september 08, 2023. Web in fact, it’s beneficial for everyone to prepare for early retirement if they can. Web taking an early withdrawal from your 401 (k) should only be. Withdrawal amount after taxes and fees. An early withdrawal from a 401 (k) means missing out on the investment growth in the fund. Web taking an early withdrawal from your 401 (k) should only be done as a last resort. Web in fact, it’s beneficial for everyone to prepare for early retirement if they can. If you tap into it. Web contribution limits for 401(k) and similar workplace retirement savings plans increased to $23,000 in 2024. Web in fact, it’s beneficial for everyone to prepare for early retirement if they can. Written by javier simon, cepf®. 401 (k) loans and certain hardship withdrawals will not be penalized. Tero vesalainen / getty images. Tero vesalainen / getty images. An early withdrawal from a 401 (k) means missing out on the investment growth in the fund. 401 (k) loans and certain hardship withdrawals will not be penalized. Early withdrawals are typically taxed as income and may be subject to a 10% penalty. In addition, your modified adjusted gross income must be less than $146,000. Our calculator will show you the true cost of cashing out your 401(k) early. Learn your options for accessing funds in your 401 (k) or 403 (b) if you retire early. There are possible situations where you are allowed to withdraw from your account without incurring an early withdrawal penalty or the 10% early required minimum distribution tax penalty. Web. Early distributions may result in a 10% tax penalty. This is the amount of time before you plan to retire or start withdrawing from your 401 (k). Web early withdrawals from a 401(k) retirement plan are taxed by the irs. Web advantages of 401 (k) accounts: Web taking an early withdrawal from your 401(k) or ira has serious consequences. Some withdrawals might qualify as hardship. 7, 2024, at 1:15 p.m. Understand the costs before you act. Reviewed by subject matter experts. Expected annual rate of return (%). Edited by jeff white, cepf®. Web in fact, it’s beneficial for everyone to prepare for early retirement if they can. Web how to withdraw early from your 401 (k) written by true tamplin, bsc, cepf®. Updated on september 08, 2023. Our calculator will show you the true cost of cashing out your 401(k) early. Learn your options for accessing funds in your 401 (k) or 403 (b) if you retire early.

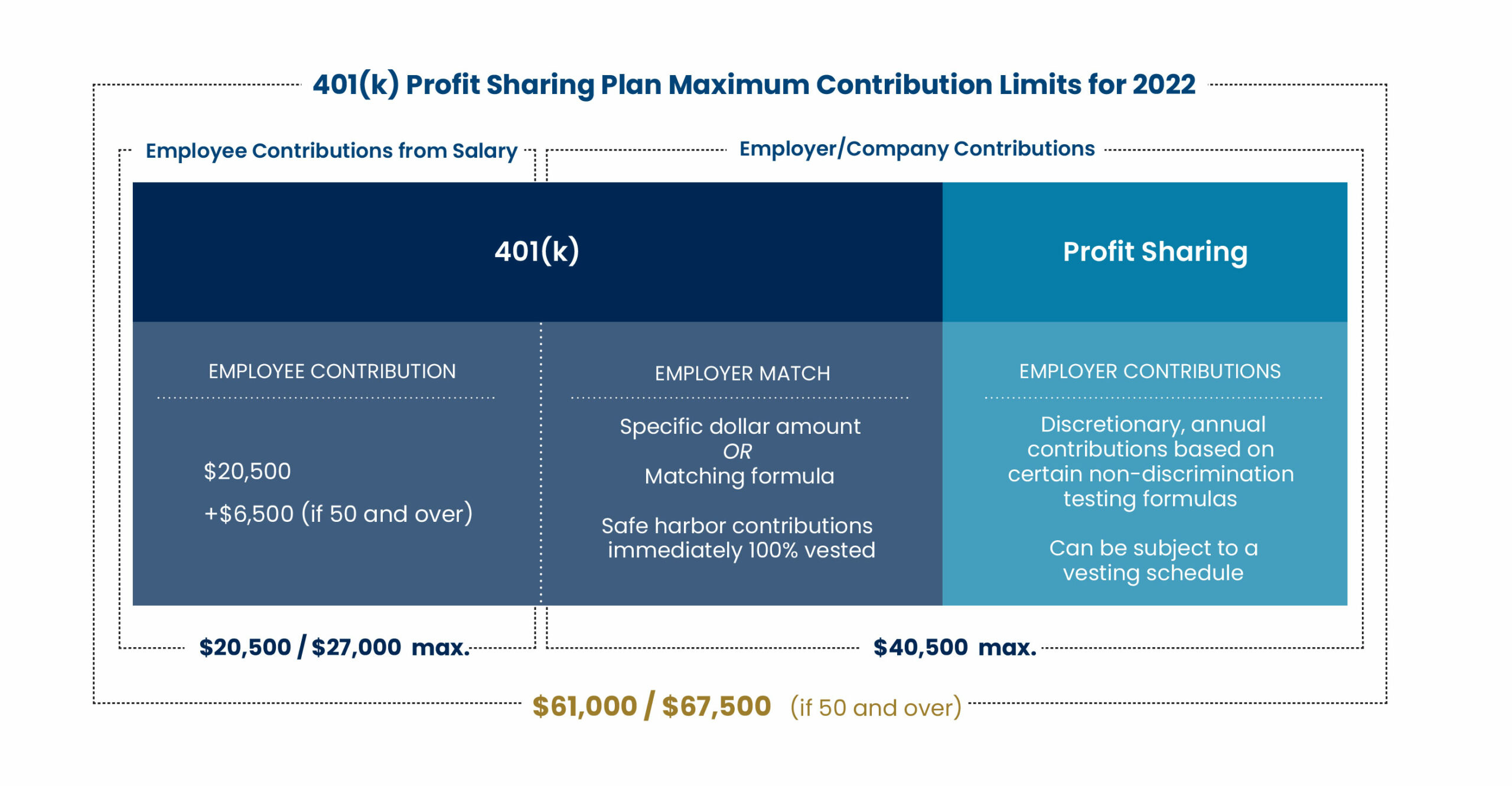

Best Guide to 401k for Business Owners 401k Small Business Owner Tips

How To Draw Money From 401k LIESSE

When Can I Draw From My 401k Men's Complete Life

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

When Can I Draw From My 401k Men's Complete Life

401(k) or IRA How to Choose Where to Put Your Money Ellevest

401k Early Withdrawal What to Know Before You Cash Out MintLife Blog

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

3 Ways to Withdraw from Your 401K wikiHow

A 401 (K) Loan Or An Early Withdrawal?

An Early Withdrawal From A 401 (K) Means Missing Out On The Investment Growth In The Fund.

But, Before You Do So, Here's A Few Things To Know About The Possible Impacts On Your Taxes Of An Early Withdrawal From Your 401 (K).

Web How To Use The Rule Of 55 To Take Early 401 (K) Withdrawals.

Related Post: