How Much Money Can I Make While Drawing Social Security

How Much Money Can I Make While Drawing Social Security - Web the threshold isn’t terribly high: The social security administration deducts $1 from your. Web under the ssa’s rules, you would receive $5,000 a year less in benefits ($31,240 minus the limit of $21,240 is $10,000, half of which is $5,000). Web here’s why experts say it pays to wait. When we figure out how much to deduct from your. Web so benefit estimates made by the quick calculator are rough. Web if you are a single tax filer and your combined income is between $25,000 and $34,000, the ssa says you may have to pay income tax on up to 50% of your benefits.; Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. However, this changes in the year you. Web for anyone born in 1960 or later, the fra is 67. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more. The limit depends on your age and the year of your earnings. Web if you are receiving benefits and working in 2024 but not due to hit fra until a later year, the earnings limit is $22,320. You lose $1 in benefits for every. Web reach full retirement age in 2024, you are considered retired in any month that your earnings are $4,960 or less and you did not perform substantial services in self. In 2023, the limit is $21,240 for under full retirement. Web there is a special rule that applies to earnings for 1 year, usually the first year of retirement. Web. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more. Web the threshold isn’t terribly high: Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. Although the quick calculator makes an initial assumption about your past. The answer depends on whether or not you have reached full retirement age. Web there is a special rule that applies to earnings for 1 year, usually the first year of retirement. There is a special rule that usually only applies in your first year of. If you’re not full retirement age in 2024, you’ll lose $1 in social security. If you will reach full. But suppose you earn that $30,000. Web $1 for every $3 of earned income above $56,520 the year you reach full retirement age until the month before you're eligible for your full benefit. Web under the ssa’s rules, you would receive $5,000 a year less in benefits ($31,240 minus the limit of $21,240 is $10,000,. 50% of anything you earn over the cap. If you will reach full. If your income has varied over the last few. The social security administration deducts $1 from your. Web once you have turned your full retirement age, there is no limit on how much you can earn while collecting social security payments. Web if you are receiving benefits and working in 2024 but not due to hit fra until a later year, the earnings limit is $22,320. If you will reach full. Social security has an annual earnings limit. Web once you have turned your full retirement age, there is no limit on how much you can earn while collecting social security. Web reach full retirement age in 2024, you are considered retired in any month that your earnings are $4,960 or less and you did not perform substantial services in self. Web in the year of fra attainment, social security deducts $1 in benefits for every $3 you earn above the limit. The limit depends on your age and the year. Web you can work while you receive social security retirement or survivors benefits, but there is a limit to how much you can earn and still get full benefits. The limit depends on your age and the year of your earnings. Web you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. We would withhold $1,300. The social security administration deducts $1 from your. Web use our retirement earnings test calculator to find out how much your benefits will be reduced. The answer depends on whether or not you have reached full retirement age. Web reach full retirement age in 2024, you are considered retired in any month that your earnings are $4,960 or less and. The limit depends on your age and the year of your earnings. Web once you have turned your full retirement age, there is no limit on how much you can earn while collecting social security payments. Web use our retirement earnings test calculator to find out how much your benefits will be reduced. Although the quick calculator makes an initial assumption about your past earnings, you will have the. Web here’s why experts say it pays to wait. Web if $25,000 a year is about average for your annual income, you may be entitled to anywhere from $800 to over $1,200 per month. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. Web if you keep working and earn that $150,000 for one more year, you might replace, say, a $40,000 salary from earlier on in your career in your social security benefits. If your income has varied over the last few. Social security has an annual earnings limit. Web how much you can earn from social security depends on your retirement age as well as your income while working. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more. When you work while drawing social security before your full retirement age, you can earn only so much before the social. However, as we’ll see, this isn’t the same. Web should your income surpass this threshold, your social security benefits will be reduced by $1 for every $2 you earn above the limit. Web for anyone born in 1960 or later, the fra is 67.

Social Security Benefits Chart

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN

How To Calculate Federal Social Security And Medicare Taxes

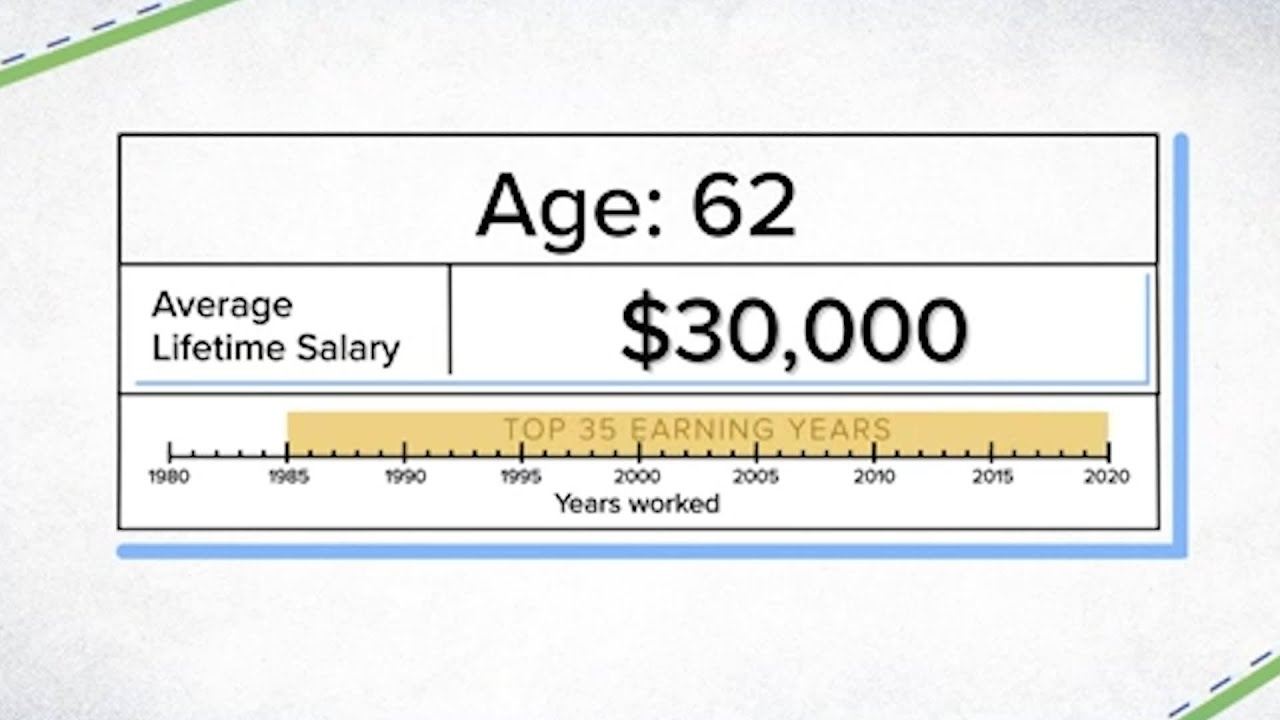

How much your Social Security benefits will be if you make 30,000

Best How Much Can I Earn While Drawing Social Security Disability of

How Much Can I Earn While on Social Security Benefits in 2020

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

How Much Can I Earn While On Social Security?

🔴Social Security Benefit If I Make 25,000 Per Year How Much

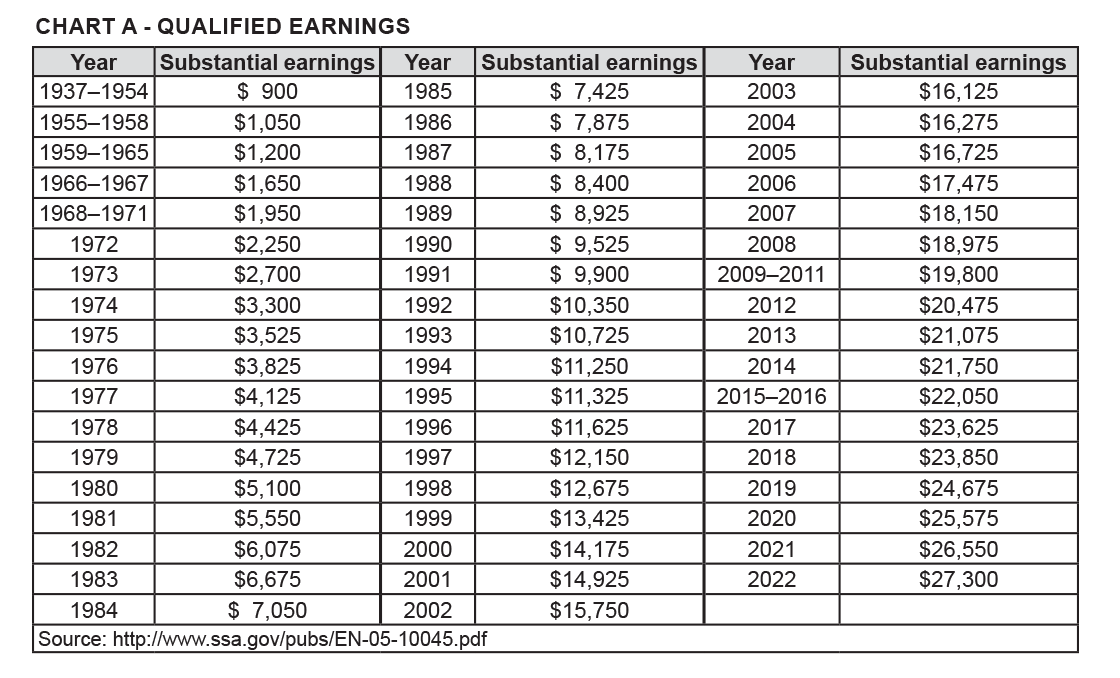

Social Security SERS

Web In The Year Of Fra Attainment, Social Security Deducts $1 In Benefits For Every $3 You Earn Above The Limit.

In The Year You Reach Your Full.

However, This Changes In The Year You.

Web If You Are Receiving Benefits And Working In 2024 But Not Due To Hit Fra Until A Later Year, The Earnings Limit Is $22,320.

Related Post: