How Much Can You Make And Draw Social Security

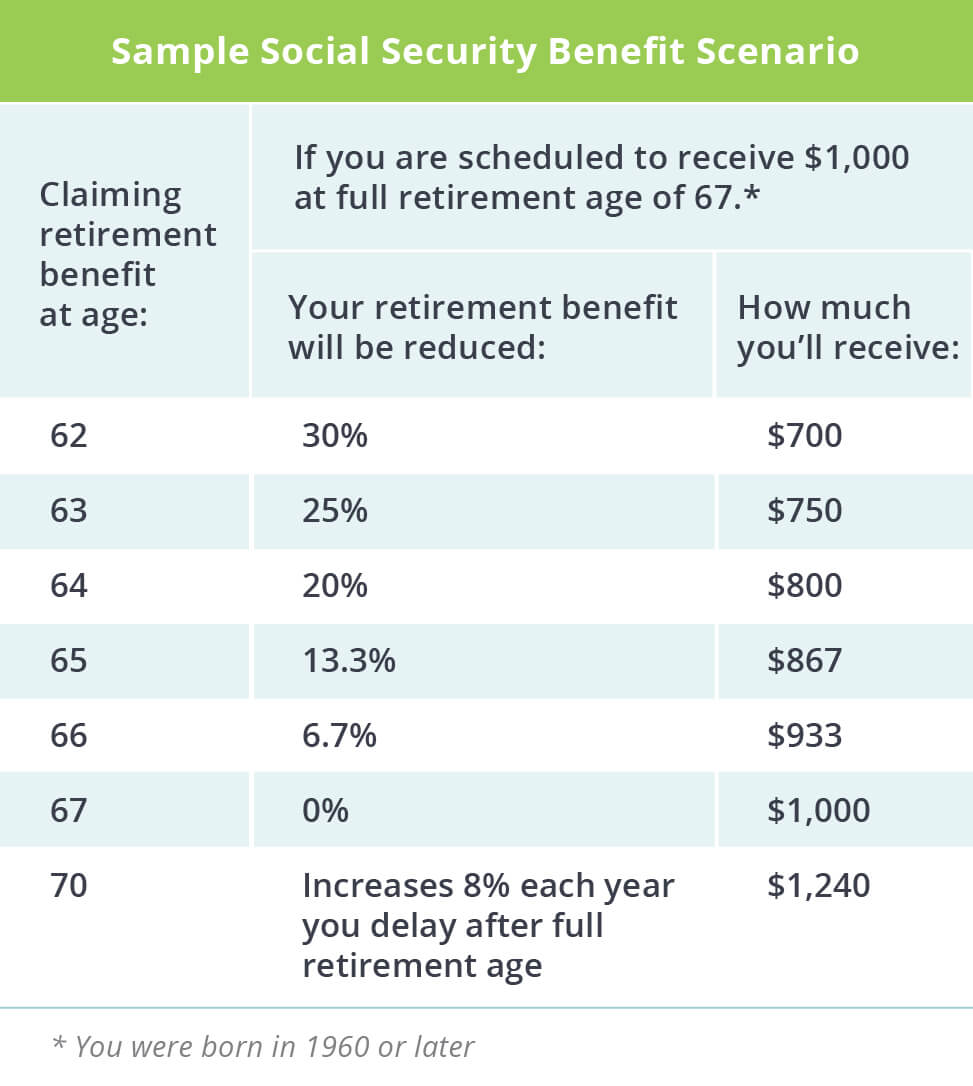

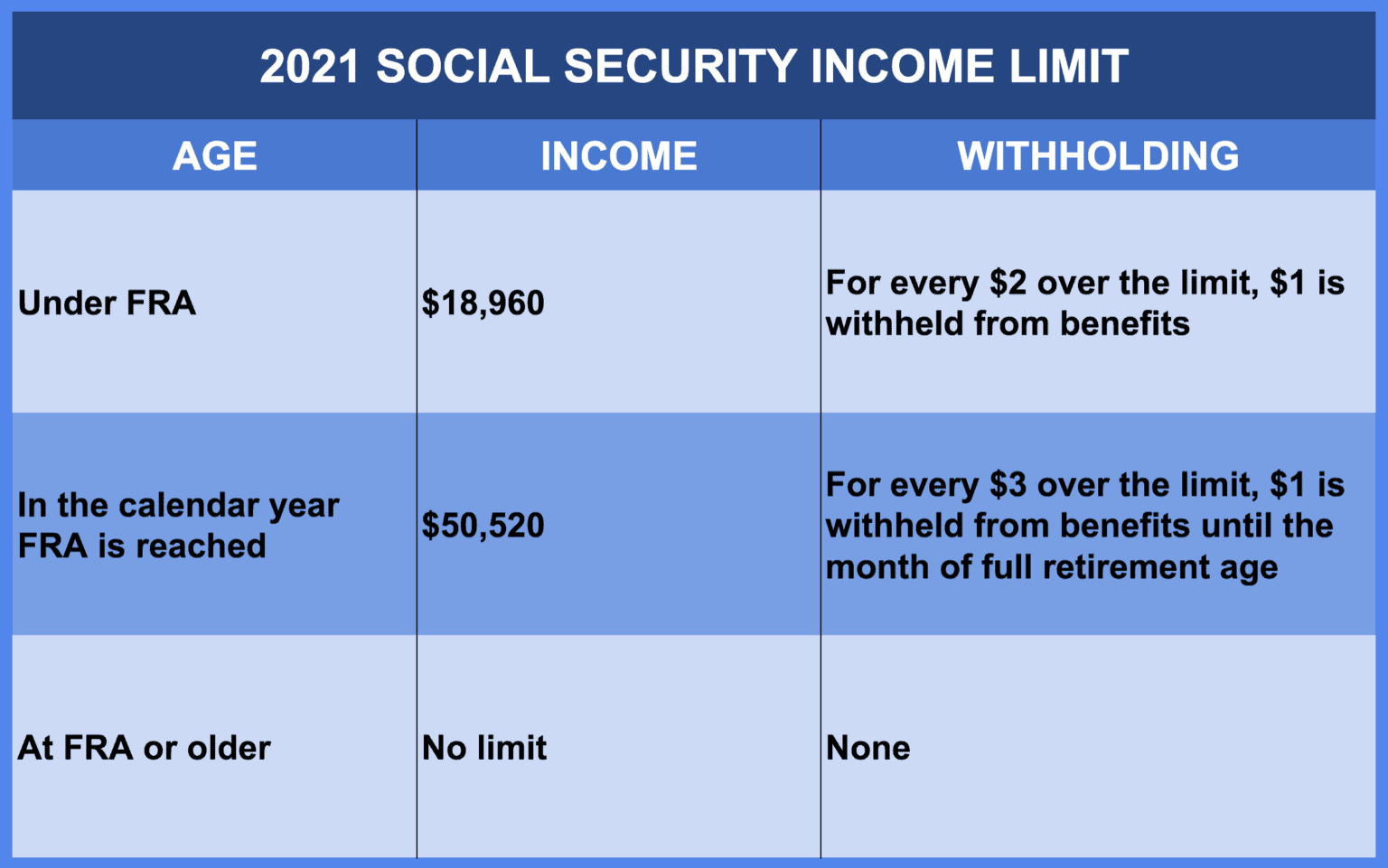

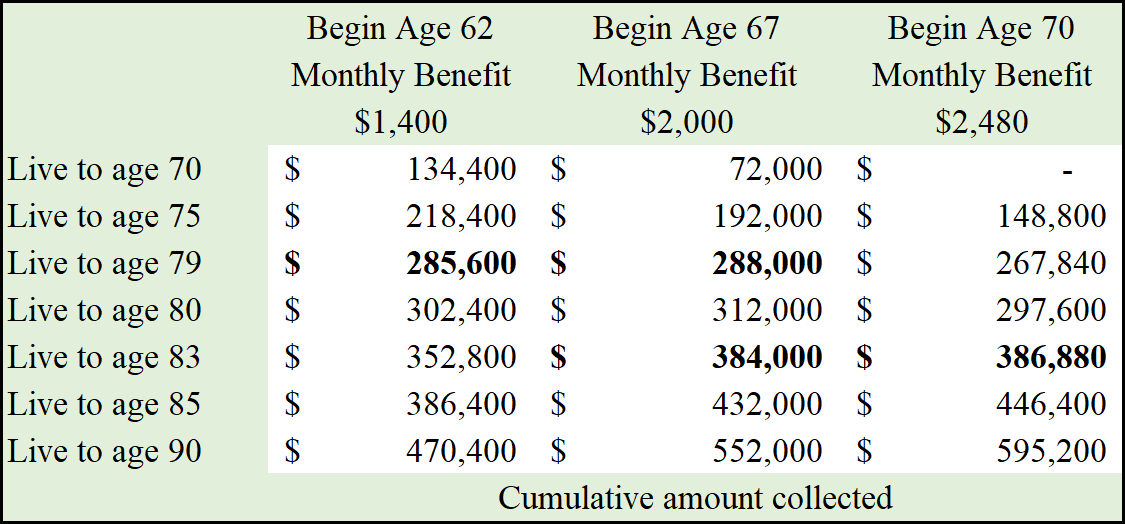

How Much Can You Make And Draw Social Security - To do this, we would withhold all benefit payments from january 2024 through march 2024. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. Web how much your social security retirement check is depends in part upon when you decide to retire. We would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). Web we use the following earnings limits to reduce your benefits: Web you are entitled to $800 a month in benefits. This helps us estimate your past and future earnings. Enter your current annual income. Web so benefit estimates made by the quick calculator are rough. You must be at least age 22 to use the form at right. The social security administration deducts $1 from your social security check. If you retire at age 62 in 2024, the maximum amount is $2,710. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. We would withhold $1,300 of your social security benefits. However, recall that you receive a. The limit is $22,320 in 2024. To do this, we would withhold all benefit payments from january 2024 through march 2024. Web so benefit estimates made by the quick calculator are rough. Web we use the following earnings limits to reduce your benefits: Web how much your social security retirement check is depends in part upon when you decide to retire. To do this, we would withhold all benefit payments from january 2024 through march 2024. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit.. Web we use the following earnings limits to reduce your benefits: The limit is $22,320 in 2024. Web in 2024, the highest monthly benefit you can receive at the full retirement age of 67 is $3,822. 50% of anything you earn over the cap. We would withhold $1,300 of your social security benefits ($1 for every $2 you earn over. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. You must be at least age 22 to use the form at right. However, recall that you receive a. This helps us estimate your past and future earnings. Web so benefit estimates made by the quick calculator are rough. We would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). 50% of anything you earn over the cap. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more than the limit). For 2024 that limit is $22,320. Web how much your social security retirement check is. The limit is $22,320 in 2024. Although the quick calculator makes an initial assumption about your past earnings, you will have the opportunity to change the assumed earnings (click on see the earnings we used after you complete and submit the form below). Web in 2024, the highest monthly benefit you can receive at the full retirement age of 67. We would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). If you retire at age 62 in 2024, the maximum amount is $2,710. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Web we use the following earnings limits to reduce your benefits:. 50% of anything you earn over the cap. For 2024 that limit is $22,320. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more than the limit). Web in 2024, the highest monthly benefit you can receive at the full retirement age of 67 is $3,822. To do this, we would withhold all benefit. However, recall that you receive a. If you retire at age 62 in 2024, the maximum amount is $2,710. Although the quick calculator makes an initial assumption about your past earnings, you will have the opportunity to change the assumed earnings (click on see the earnings we used after you complete and submit the form below). Web you are entitled. You must be at least age 22 to use the form at right. This helps us estimate your past and future earnings. Web in 2024, the highest monthly benefit you can receive at the full retirement age of 67 is $3,822. Web you are entitled to $800 a month in benefits. To do this, we would withhold all benefit payments from january 2024 through march 2024. For 2024 that limit is $22,320. Web we use the following earnings limits to reduce your benefits: Enter your current annual income. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. If you retire at age 62 in 2024, the maximum amount is $2,710. Although the quick calculator makes an initial assumption about your past earnings, you will have the opportunity to change the assumed earnings (click on see the earnings we used after you complete and submit the form below). We would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. Web so benefit estimates made by the quick calculator are rough. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more than the limit). Web how much your social security retirement check is depends in part upon when you decide to retire.

What’s The Right Age To Start Drawing Social Security? To Our

Social Security Benefits Chart

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

How Does Social Security Work? Top Questions Answered

Social Security Earnings Limit 2024 Binny Noelyn

When is it best to begin drawing Social Security Benefits?

Managing Your Social Security Benefits

How much can you earn in 2022 and draw social security?

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN

How much can you earn and collect on Social Security?

The Limit Is $22,320 In 2024.

Web During 2024, You Plan To Work And Earn $24,920 ($2,600 Above The $22,320 Limit).

50% Of Anything You Earn Over The Cap.

However, Recall That You Receive A.

Related Post: