How Much Can You Earn Drawing Social Security

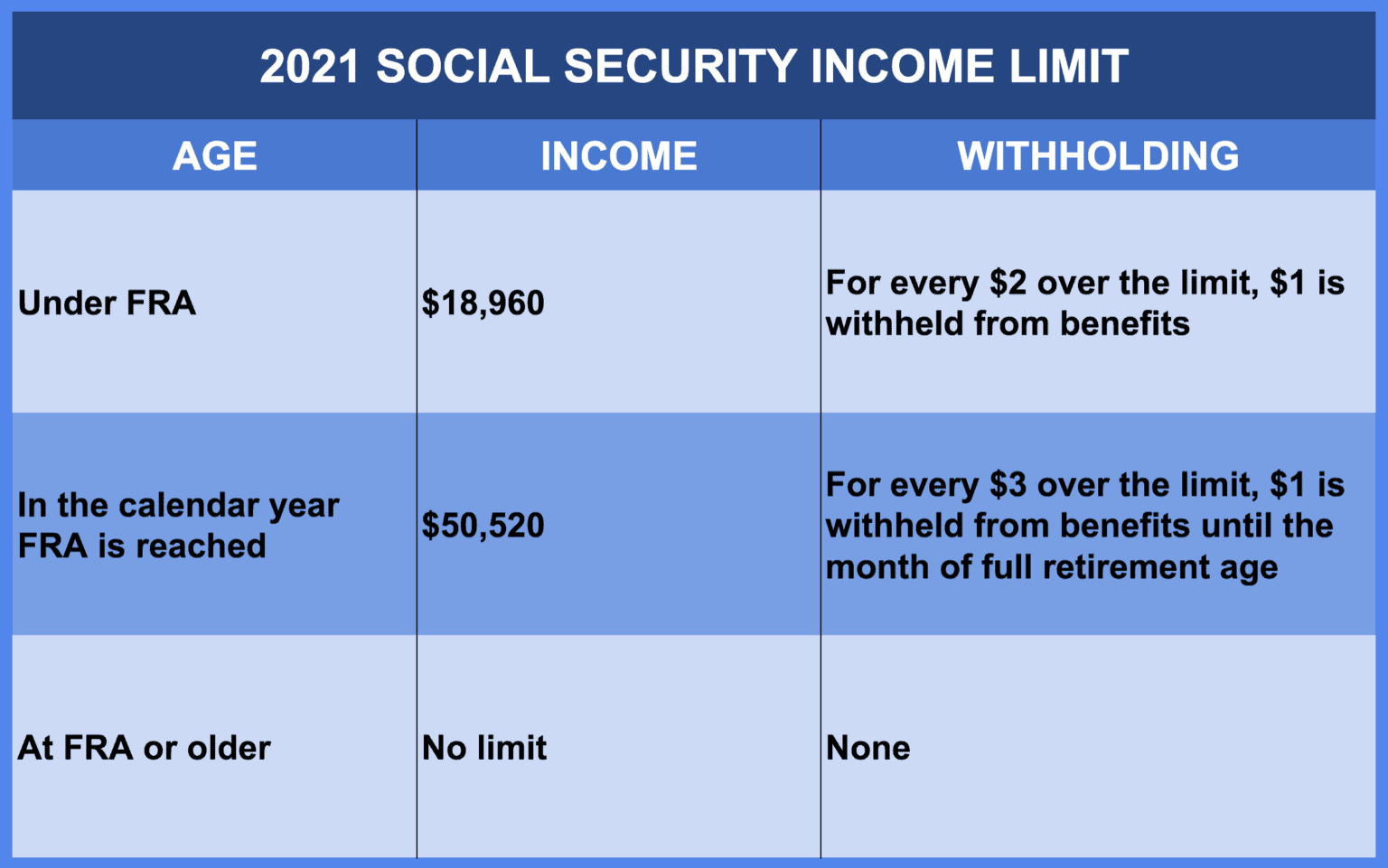

How Much Can You Earn Drawing Social Security - Web in 2024, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn. Find out the income limits, penalties and exceptions for different. Web as you can see, it pays to wait when you've already earned enough in your career to maximize your monthly social security benefit. Web published october 10, 2018. You can earn up to 4 credits. During that period, the earnings. Even if you file taxes jointly, social security does not count both spouses’ incomes against one spouse’s. Find out the earnings limits, exceptions and how to. Have worked in jobs covered by social security. Web the threshold isn’t terribly high: Web be under full retirement age for all of 2024, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial services in self. The amount needed to earn 1 credit automatically increases each year. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. One easy trick could pay you as much as. Web learn how much you can earn while on social security and how it affects your benefits. Web published october 10, 2018. Web be. The amount needed to earn 1 credit automatically increases each year. Even if you file taxes jointly, social security does not count both spouses’ incomes against one spouse’s. Web so benefit estimates made by the quick calculator are rough. Web we use the following earnings limits to reduce your benefits: For 2024 that limit is $22,320. You can earn up to a maximum of 4 credits per year. The amount needed to earn 1 credit automatically increases each year. Web so with the 2023 annual limit of $21,240, the monthly limit is $1,770. Web so benefit estimates made by the quick calculator are rough. If you’re not full retirement age in 2024, you’ll lose $1 in. Web calculating your social security retirement benefit — a crucial source of income for many retirees — can be an important step in choosing when to retire (signing. The one exception is during the calendar year you attain full retirement age. Web be under full retirement age for all of 2024, you are considered retired in any month that your. Web spousal benefits cap at 50% of a spouse's monthly payout. Web the amount needed for a credit in 2024 is $1,730. Web learn how much you can earn while on social security and how it affects your benefits. Have worked in jobs covered by social security. It is important to note that you cannot. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. Web in 2024, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn. Web as you can see, it pays. During that period, the earnings. / updated december 08, 2023. Web calculating your social security retirement benefit — a crucial source of income for many retirees — can be an important step in choosing when to retire (signing. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). Although the quick calculator makes an initial. Web so with the 2023 annual limit of $21,240, the monthly limit is $1,770. Web the amount needed for a credit in 2024 is $1,730. Benefits & eligibilityhome & familyanswers to your questionsveterans resources The one exception is during the calendar year you attain full retirement age. Web if you are on social security for the whole year and make. You can earn up to a maximum of 4 credits per year. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). Web the amount needed for a credit in 2024 is $1,730. Web be under full retirement age for all of 2024, you are considered retired in any month that your earnings are $1,860. Find out the income limits, penalties and exceptions for different. Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. Web learn how much you can earn while on social security and how it affects your benefits. Web learn how your earnings can reduce your social security benefits before and after full retirement age. You can earn up to 4 credits. The one exception is during the calendar year you attain full retirement age. Web so with the 2023 annual limit of $21,240, the monthly limit is $1,770. Web we use the following earnings limits to reduce your benefits: Web under this rule, you can get a full social security benefit for any whole month you are retired and earnings are below the monthly limit. For 2024 that limit is $22,320. Benefits & eligibilityhome & familyanswers to your questionsveterans resources Web the threshold isn’t terribly high: To qualify for social security disability insurance (ssdi) benefits, you must: Web just how much can you earn while receiving social security? Find out the earnings limits, exceptions and how to. Web if you are on social security for the whole year and make $30,000 from work, you are $7,680 over the limit and lose $3,840 in benefits.

Social Security Age Chart When to Start Drawing Bene... Ticker Tape

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

Introduction to Social Security Aspire Wealth Advisory

Social Security Benefits Chart

How Much Can I Earn Without Losing My Social Security?

When is it best to begin drawing Social Security Benefits?

How much can you earn in 2022 and draw social security?

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN

Social Security Limit 2021 Social Security Intelligence

What’s The Right Age To Start Drawing Social Security? To Our

Web As You Can See, It Pays To Wait When You've Already Earned Enough In Your Career To Maximize Your Monthly Social Security Benefit.

If You Are Under Full Retirement Age For The Entire Year, We Deduct $1 From Your Benefit Payments For Every $2 You Earn Above The Annual Limit.

Although The Quick Calculator Makes An Initial Assumption About Your Past Earnings, You Will Have.

Web Learn How Much You Can Earn Before Your Social Security Benefits Are Reduced Or Withheld In 2024, Depending On Your Age And Income Level.

Related Post: