Draw Period Home Equity Line

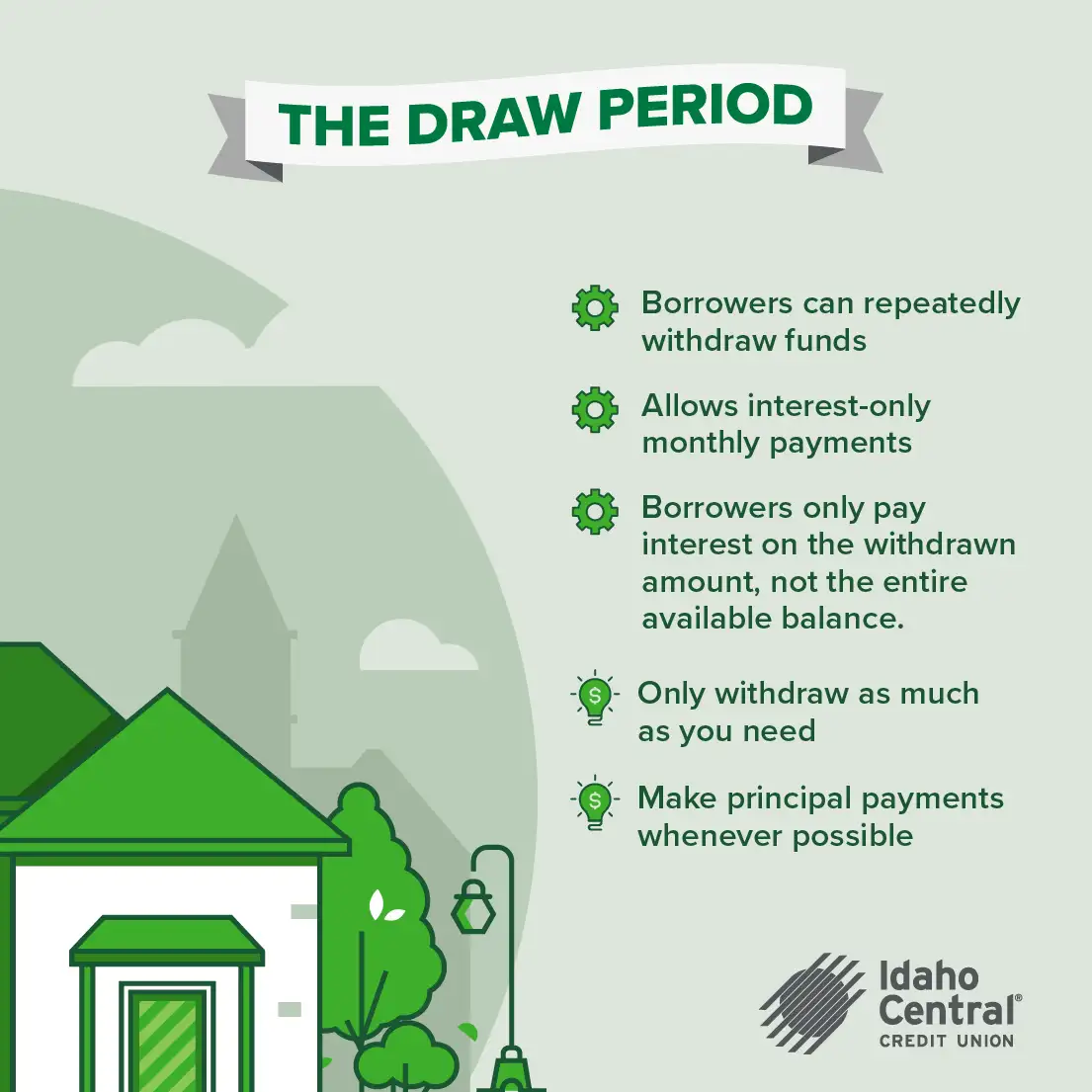

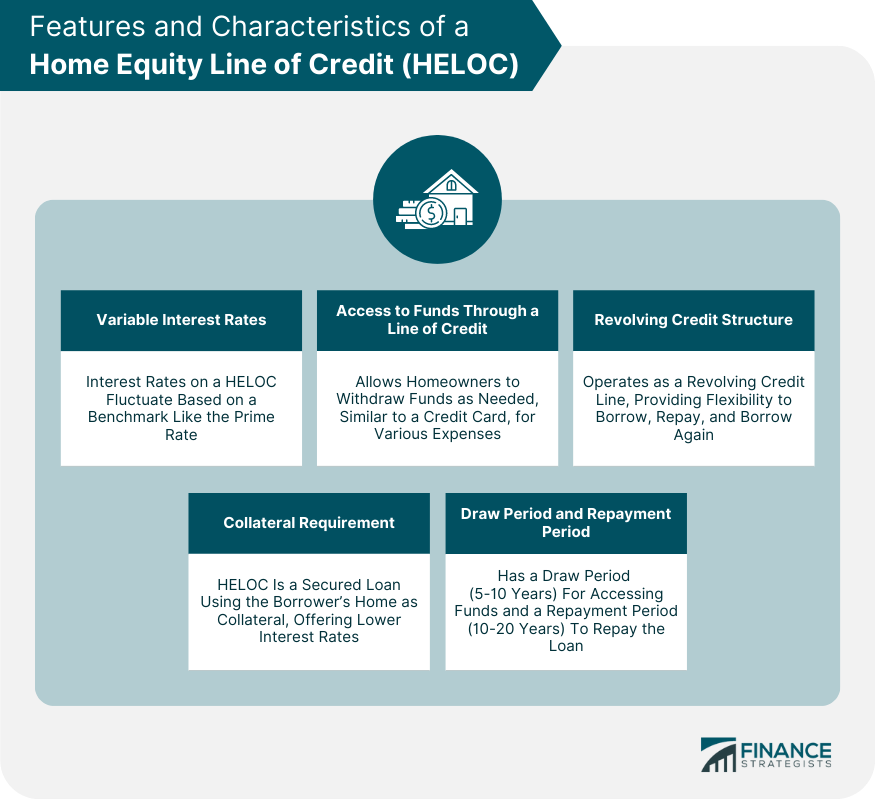

Draw Period Home Equity Line - During the draw period, borrowers have the option to use. During the draw period (usually 10 to 15 years), you can. The draw period typically lasts up to. A standard home equity line of credit, your access to funds will end when you reach the end of draw. Know your draw period for a heloc. Web the terms of every heloc vary but they most commonly have a draw period of 10 years and a repayment period of around 15 years. Draw periods vary in length depending on each one’s terms, but typically range between 5 and 15 years. One way to tap your home for cash is to consider a home equity line of credit, or heloc. To make withdrawals, you’ll use checks or a card you can swipe. The draw period at the beginning of the loan and the repayment period at the end. Ten years is the most common draw period length. Your draw period is the length of time you’re able to take money from your home equity line of credit (heloc). A home equity line of credit (heloc) is divided into two distinct periods: During the draw period, borrowers have the option to use. Web the years that you have been. Web the years that you have been able to access funds is known as the draw period. Web what is the draw period on a home equity line of credit? Draw periods vary in length depending on each one’s terms, but typically range between 5 and 15 years. This first phase usually lasts for 10 years, and you can borrow. And your monthly payments will now include principal and interest. When the draw period ends, you'll have to repay the amount you drew. During the draw period you can withdraw funds. They’re unique because they work in two phases: During this time, you can draw as much as you need up to your total available credit line. The draw period typically lasts up to 10. Immediately after opening your loan, you’ll have a draw period during which you can use your heloc card or checkbook to charge expenses, withdrawing against your heloc limit. Web a heloc’s draw period refers to the period of time during which a borrower can withdrawal funds from the line of credit. They’re. Web a heloc’s draw period refers to the period of time during which a borrower can withdrawal funds from the line of credit. Web you can draw from a home equity line of credit and repay all or some of it monthly, somewhat like a credit card. You’ll write special checks or use a credit card to access funds during. During this time, you can draw as much as you need up to your total available credit line. Immediately after opening your loan, you’ll have a draw period during which you can use your heloc card or checkbook to charge expenses, withdrawing against your heloc limit. Web a home equity line of credit is a type of second mortgage that. During the draw period you can withdraw funds. The draw period at the beginning of the loan and the repayment period at the end. Its duration, accessing funds and repayment. Web the terms of every heloc vary but they most commonly have a draw period of 10 years and a repayment period of around 15 years. Web what is the. A home equity line of credit (heloc) is divided into two distinct periods: Discover how to make informed decisions about your home equity line of credit. A draw period and a repayment period. Unlike a credit card, however, helocs are not intended for minor expenses. Discover® home loans offers a home equity loan product, but does not offer helocs. During the draw period you can withdraw funds. Web the terms of every heloc vary but they most commonly have a draw period of 10 years and a repayment period of around 15 years. Web what is the draw period on a home equity line of credit? The heloc end of draw period is when you enter the repayment phase. Heloc terms vary, and a. During the draw period, borrowers have the option to use. Web a home equity line of credit (heloc) draw period is the period of time after a heloc has been opened and before the repayment period begins. Web the terms of every heloc vary but they most commonly have a draw period of 10 years. They’re unique because they work in two phases: When the draw period ends, you'll have to repay the amount you drew. Helocs let you turn a portion of your home equity into a line of credit, which functions much like a credit card. You’ll write special checks or use a credit card to access funds during the draw period. You’ll enter the repayment period. And your monthly payments will now include principal and interest. One way to tap your home for cash is to consider a home equity line of credit, or heloc. A heloc—or home equity line of credit —is a way for homeowners to tap the equity they have in their house. The draw period is the initial phase of a home equity line of credit (heloc), during which you can withdraw funds, up to your credit limit. Reviewed by jim mccarthy, cfp®. During the draw period you can withdraw funds. Ten years is the most common draw period length. It varies from lender to lender, but it’s usually from five to 10 years. A home equity line of credit (heloc) is divided into two distinct periods: Your draw period is the length of time you’re able to take money from your home equity line of credit (heloc). Heloc terms vary, and a.

What is the End of Draw Period on my Home Equity Line of Credit? YouTube

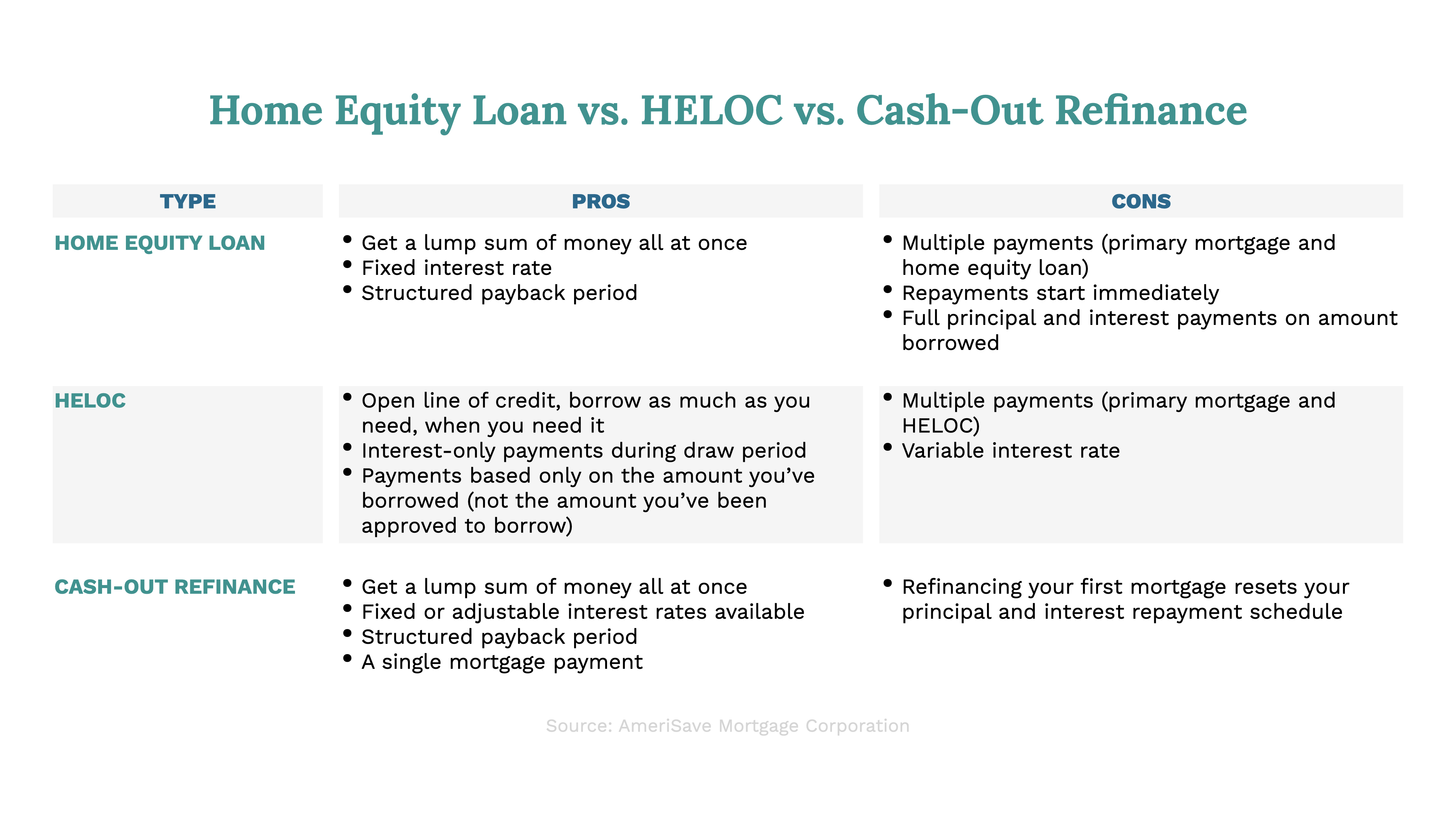

Guide to Understanding Home Equity Lines (HELOC) and Loans AmeriSave

HELOC Do’s and Don’ts A StepbyStep Guide to Home Equity Lines of

Heloc Draw Period Repayment Calculator EASY DRAWING STEP

Home Equity Line of Credit Definition, Requirements, Features

HELOC Draw Period A Simple Guide for Borrowers

HELOC Draw Period A Simple Guide for Borrowers

Heloc Draw Period Repayment Calculator EASY DRAWING STEP

HELOC Draw Period A Simple Guide for Borrowers

Home Equity Loan (HELOC) Explained Landlord Glossary

Draw Periods Vary In Length Depending On Each One’s Terms, But Typically Range Between 5 And 15 Years.

Web A Home Equity Line Of Credit Is A Type Of Second Mortgage That Lets Homeowners Borrow Against Their Home Equity As A Line Of Credit.

It Will Last For Several Years, Typically 10 Years Max.

Web Written By Aly Yale.

Related Post: