Can You Draw Social Security From A Deceased Spouse

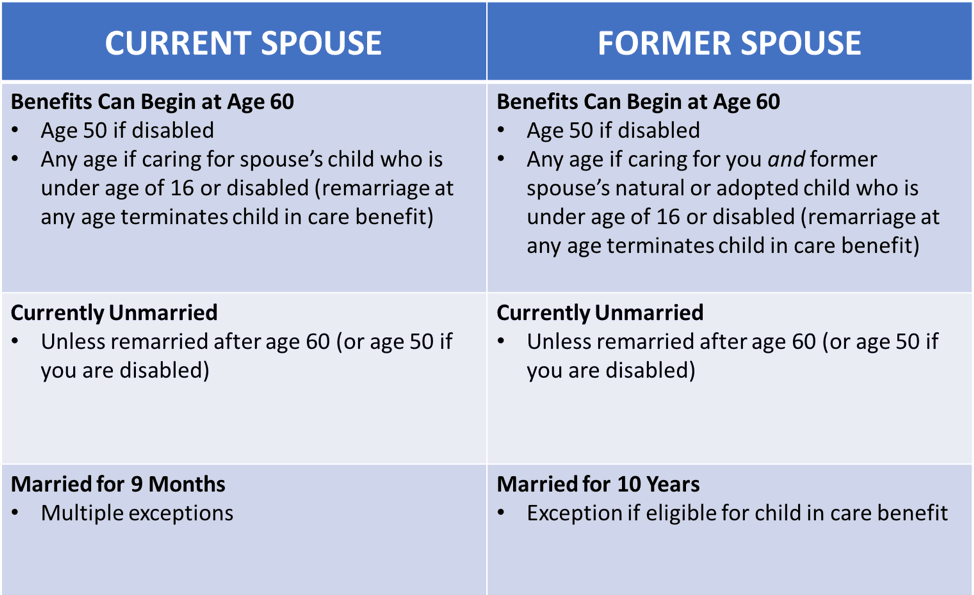

Can You Draw Social Security From A Deceased Spouse - If you’re getting benefits based on your own work, call or visit us. If your new spouse is a social security beneficiary, you may want to apply for spouse’s benefits on that record. Widows and widowers who are under age 60 and. Web the earliest a widow or widower can start receiving social security survivors benefits based on age will remain at age 60. If you’re getting benefits as a spouse based on your spouse’s work, we’ll change your payments to survivors benefits when you report the death to us. Web if you remarry after age 60 — you may still become entitled to benefits on your prior deceased spouse’s social security earnings record. There are circumstances, however, in which you can start sooner. You become eligible at age 60. Web if your spouse had not yet reached full retirement age, social security bases the survivor benefit on the deceased’s primary insurance amount — 100 percent of the benefit he or she would have been entitled to, based on lifetime earnings. A spouse who doesn’t live in the same home may be eligible if they can get benefits based on the record of the person who died. Web if you’re already getting social security benefits. If living apart and they were receiving certain social security benefits on the deceased’s record, they may be. If we need more information, we’ll contact you. Web if you remarry after age 60 (age 50 if you have a disability), you may continue to be eligible for survivors benefits on your deceased. If you’re getting benefits based on your own work, call or visit us. Check out if you are divorced for more information. How your spouse earns social security survivors benefits. Social security spousal benefits allow spouses to claim benefits based on their partner's earnings record. How much you receive will depend on your age, the amount of benefits you may. Web social security spousal benefits can be an important part of retirement planning for couples considering that option. Web the basics about survivors benefits. Web if you are already receiving a spousal benefit when your husband or wife dies, social security will in most cases convert it automatically to a survivor benefit once the death is reported. In this article,. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. Eligibility for spousal benefits typically requires that the spouse. Web when a spouse passes, the ssa pays an eligible surviving spouse a percentage of the deceased's retirement benefits, depending on the deceased's age: A surviving spouse can collect 100 percent. But you don’t have to navigate your finances and benefits alone. Navigating social security widows benefits after the death of a loved one can feel even more complicated. Web if you’re already getting social security benefits. If the deceased did not reach full retirement age, the surviving spouse can receive 100% of the retirement benefit. You have been married for. Web when a spouse passes, the ssa pays an eligible surviving spouse a percentage of the deceased's retirement benefits, depending on the deceased's age: If there’s no spouse, minor children may be eligible for the payment. You become eligible at age 60. Web a surviving spouse, surviving divorced spouse, unmarried child, or dependent parent may be eligible for monthly survivor. If you’re getting benefits as a spouse based on your spouse’s work, we’ll change your payments to survivors benefits when you report the death to us. Web if you’re already getting social security benefits. If your spouse passes away and you are 60 or older, you may be eligible for survivor benefits. Web social security spousal benefits can be an. Web when a spouse passes, the ssa pays an eligible surviving spouse a percentage of the deceased's retirement benefits, depending on the deceased's age: Web if my spouse dies, can i collect their social security benefits? There are circumstances, however, in which you can start sooner. But you don’t have to navigate your finances and benefits alone. If we need. If you’re getting benefits as a spouse based on your spouse’s work, we’ll change your payments to survivors benefits when you report the death to us. Navigating social security widows benefits after the death of a loved one can feel even more complicated. If the deceased did not reach full retirement age, the surviving spouse can receive 100% of the. Notify the social security administration that you were married more than once and may qualify for benefits on more than one spouse's earnings record. If you are working and paying into social security, some of those taxes you pay are for survivors benefits. Your spouse is already receiving retirement benefits. But you don’t have to navigate your finances and benefits. You have been married for at least one year. But you don’t have to navigate your finances and benefits alone. You become eligible at age 60. Web social security survivor benefits for a spouse. Web the basics about survivors benefits. Divorced spouse’s benefits — generally, if you remarry, benefits paid to you from your prior spouse’s account stop. Web social security spousal benefits can be an important part of retirement planning for couples considering that option. If the number of months exceeds 36, then the benefit is further reduced 5/12. If living apart and they were receiving certain social security benefits on the deceased’s record, they may be. Eligibility for spousal benefits typically requires that the spouse. Web if you are already receiving a spousal benefit when your husband or wife dies, social security will in most cases convert it automatically to a survivor benefit once the death is reported. If you’re getting benefits as a spouse based on your spouse’s work, we’ll change your payments to survivors benefits when you report the death to us. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If you are working and paying into social security, some of those taxes you pay are for survivors benefits. We break down everything you need to know about survivors benefits. In this article, we’ll go over the rules and exceptions for receiving these benefits and enable you to build a plan for your survivors benefits.

If My Spouse Dies Can I Collect Their Social Security Benefits?

3 Most Important Things to Know About the Social Security Surviving

Can I Draw Social Security from My Husband's Social Security Disability?

Social Security Benefits For Spouses

When Can I Draw Social Security From My Deceased Husband? Retire Gen Z

When Can I Draw Social Security From My Deceased Husband? Retire Gen Z

Top 10 can you collect deceased spouse social security if you remarry

Can I Collect My Exspouse's or Deceased Spouse's Social Security? 🤔

Can I Collect My Exspouse's or Deceased Spouse's Social Security? ğŸ

When Can I Draw Social Security From My Deceased Husband? Retire Gen Z

Web If You Remarry After Age 60 — You May Still Become Entitled To Benefits On Your Prior Deceased Spouse’s Social Security Earnings Record.

In Most Cases The Widow Or Widower Of A Deceased Worker Can Begin Collecting A Survivor Benefit As Early As Age 60 (Although The Monthly Payment Increases If You Wait — See Number 4).

Social Security Spousal Benefits Allow Spouses To Claim Benefits Based On Their Partner's Earnings Record.

How Your Spouse Earns Social Security Survivors Benefits.

Related Post: