Age To Draw From Ira

Age To Draw From Ira - If you withdraw roth ira earnings before age 59½, a 10% penalty usually. What if i withdraw money from my ira? Do you have an overall retirement plan in place? Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential taxes and penalties, along. Retirement calculatorfund comparison toolretirement planningmarket insights 1, 2033, the rmd age would be 73. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise) tax or penalty on that. Learn how to turn savings into income and how to generate retirement income that can last. You can reduce taxes by sending required minimum distributions to a charity. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential taxes and penalties, along. 45+ years experienceserving all 50 stateseasy setuppersonalized service This. 45+ years experienceserving all 50 stateseasy setuppersonalized service Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in. 31, 2022 and age 73 before jan. Web but you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least five. You can withdraw roth individual retirement account (ira) contributions at any time. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a roth—whether you need it. Web for those who reach age 72 after dec. Web updated on. Retirement calculatorfund comparison toolretirement planningmarket insights Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; Web you generally have to start taking withdrawals from your ira, simple ira, sep ira, or retirement plan account when you reach age 72 (73 if you reach age 72 after. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; Web required minimum distribution calculator. This choice is typically made. Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or. Web withdrawals must be taken. Web but you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least five years. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still working. If you transfer your traditional or roth. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. Web required minimum distribution calculator. What if i withdraw money from my ira? Web but you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least five years.. Learn how to turn savings into income and how to generate retirement income that can last. Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or. 31, 2022 and age 73 before jan. If you’ve inherited an individual retirement account since 2020, you could have a shorter timeline. Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in. You can withdraw roth individual retirement account (ira) contributions at any time. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise). If you’ve inherited an individual retirement account since 2020, you could have a shorter timeline to withdraw the money, which can trigger tax consequences. Learn how to turn savings into income and how to generate retirement income that can last. What if i withdraw money from my ira? Web are you over age 59 ½ and want to withdraw? You. Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in. What if i withdraw money from my ira? Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. 1, 2033, the rmd age would be 73. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a roth—whether you need it. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still working. Do you have an overall retirement plan in place? When you set up your roth ira account you will be asked to select investments you want to buy with your contributions. 31, 2032, the rmd age would. Learn how to turn savings into income and how to generate retirement income that can last. But it's still critical to know how your withdrawal may be taxed. For those who reach age 74 after dec. Web but you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least five years. Web beneficiaries of individual retirement accounts don’t have to take required minimum distributions this year — a responsibility that can normally result in owing more in taxes. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after. Retirement calculatorfund comparison toolretirement planningmarket insights

Traditional or Roth IRA A Guide by and Age Roth ira

Step by Step How to Draw Ira from 11eyes

Learn How to Draw Ira Fingerman from Harvey Beaks (Harvey Beaks) Step

Step by Step How to Draw Ira Gamagori from Kill la Kill

How to Draw Ira from 11eyes (11eyes) Step by Step

How To Draw Ira 如何画艾勒 YouTube

Roth IRA Withdrawal Rules and Penalties The TurboTax Blog

Roth IRA Withdrawal Rules and Penalties The TurboTax Blog

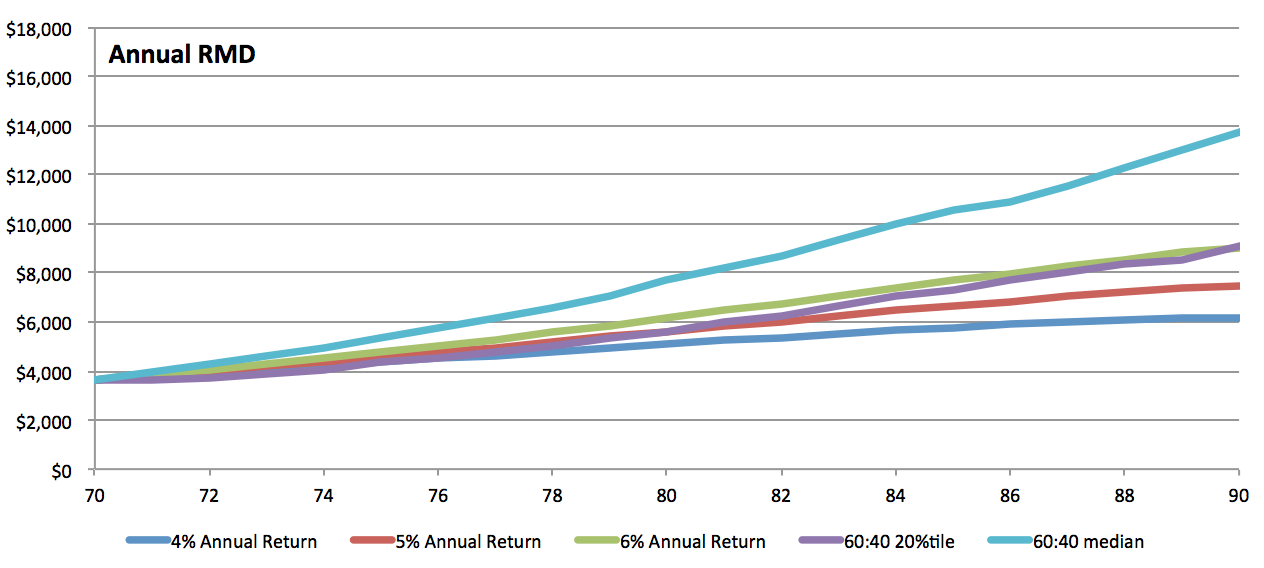

Drawing Down Your IRA What You Can Expect Seeking Alpha

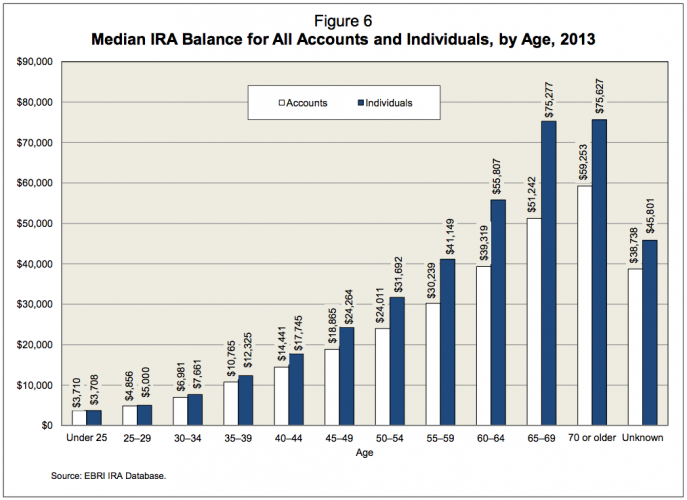

How Much Should I Have Saved In My Traditional IRA At Various Ages?

31, 2022 And Age 73 Before Jan.

Web Withdrawals Must Be Taken After Age 59½.

Web Specifically, If A Taxpayer Did Not Take A Specified Rmd In 2021 Or 2022 Related To An Inherited Ira, The Irs Agreed Not To Impose An Extra (Excise) Tax Or Penalty On That.

You Can Reduce Taxes By Sending Required Minimum Distributions To A Charity.

Related Post: