Age To Draw From 401K Without Penalty

Age To Draw From 401K Without Penalty - It’s even harder to tap 401 (k) funds without paying regular income tax. For example, you won’t be able to withdraw your roth 401(k) contributions until age 59½ or you experience another qualifying event such as disability, termination of employment, financial hardship, or death. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs treats your withdrawal. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Web however, except in special cases you can’t withdraw from your 401 (k) before age 59.5 even then you’ll usually pay a 10% penalty. If you need funds, you may be able to tap into your 401 (k) funds without penalty, even if you're under 59½. The rule of 55 applies only to your current workplace retirement. Depending on the terms of the plan, distributions may be: Web taking an early withdrawal from a 401(k) retirement account before age 59½ could have steep financial penalties. In addition, your modified adjusted gross income must be less than $146,000 to $161,000 (for single filers) or $230,000 to $240,000. Web you reach age 59½ or experience a financial hardship. This rule is only waived when certain exceptions apply and the. Someone turning 70 this year would have been born in 1954, giving them a full retirement age of just 66. Web the minimum withdrawal age for a traditional 401 (k) is technically 59½. Web under particular circumstances, you can. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Has set the standard retirement age at 59 ½. If that happens, you might need to begin taking distributions from your 401 (k). Web the irs rule of 55. Your ira savings is always yours when you need it—whether for retirement or emergency funds. Depending on the terms of the plan, distributions may be: Web if you need to dip into a retirement account before you retire—whether it's a 401 (k), ira, or another type of plan—you might have to pay a penalty. Retiring or taking a pension before. Are you under age 59 ½ and want to take an ira withdrawal? Web what is a 401 (k) and ira withdrawal penalty? Your ira savings is always yours when you need it—whether for retirement or emergency funds. If you’re contemplating early retirement, you should know how the rule of 55 works. Web ordinarily, you can’t withdraw money from these. Web if you need to dip into a retirement account before you retire—whether it's a 401 (k), ira, or another type of plan—you might have to pay a penalty. This rule is only waived when certain exceptions apply and the. In addition, your modified adjusted gross income must be less than $146,000 to $161,000 (for single filers) or $230,000 to. Retiring or taking a pension before 59 1/2. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. For example, you won’t be able to withdraw your roth 401(k) contributions until. But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. However, there are strategies for getting access to funds without triggering distribution taxes and penalties. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Web you can begin to. If that happens, you might need to begin taking distributions from your 401 (k). But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. Retiring or taking a pension before 59 1/2. However, there are strategies for getting access to funds without triggering distribution taxes and penalties. The rule of 55. You can withdraw money from your 401 (k) before 59½, but it’s. If you’re contemplating early retirement, you should know how the rule of 55 works. The rule of 55 applies only to your current workplace retirement. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at. If that happens, you might need to begin taking distributions from your 401 (k). Your ira savings is always yours when you need it—whether for retirement or emergency funds. Generally, if you withdraw money from a 401 (k) before the plan’s normal retirement age or from an ira before turning 59 ½, you’ll pay an. But just because 401 (k). But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. Web under particular circumstances, you can withdraw from a 401 (k) between 55 and 59½ without being penalized. If you qualify for a hardship withdrawal, certain immediate expenses. If you’re contemplating early retirement, you should know how the rule of 55 works. Has set the standard retirement age at 59 ½. Retiring or taking a pension before 59 1/2. In certain circumstances, the plan administrator must obtain your consent before making a distribution. Depending on the terms of the plan, distributions may be: Web what is a 401 (k) and ira withdrawal penalty? Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Exceptions to the early distribution tax. Web you reach age 59½ or experience financial hardship. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web ordinarily, you can’t withdraw money from these plans before age 59½ without facing a 10% early withdrawal penalty.

at what age do you have to take minimum distribution from a 401k Hoag

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg)

When should you start taking money out of your 401k? Leia aqui What

at what age do you have to take minimum distribution from a 401k Hoag

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

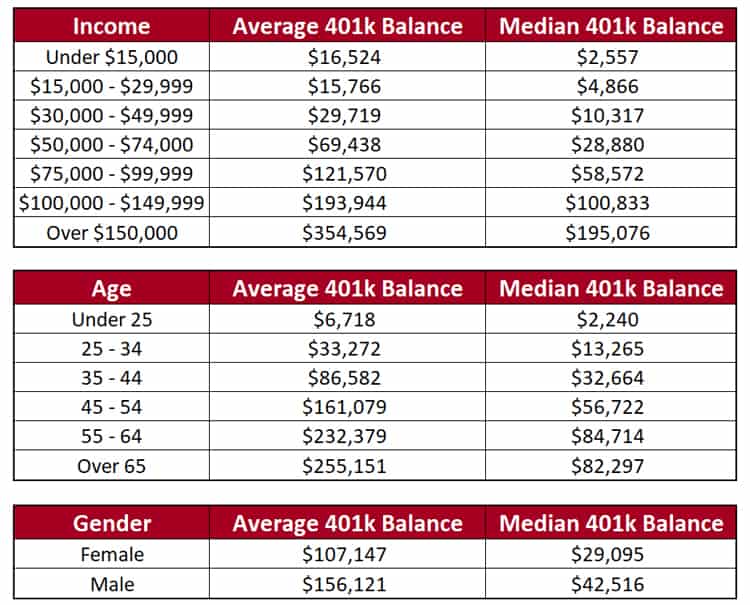

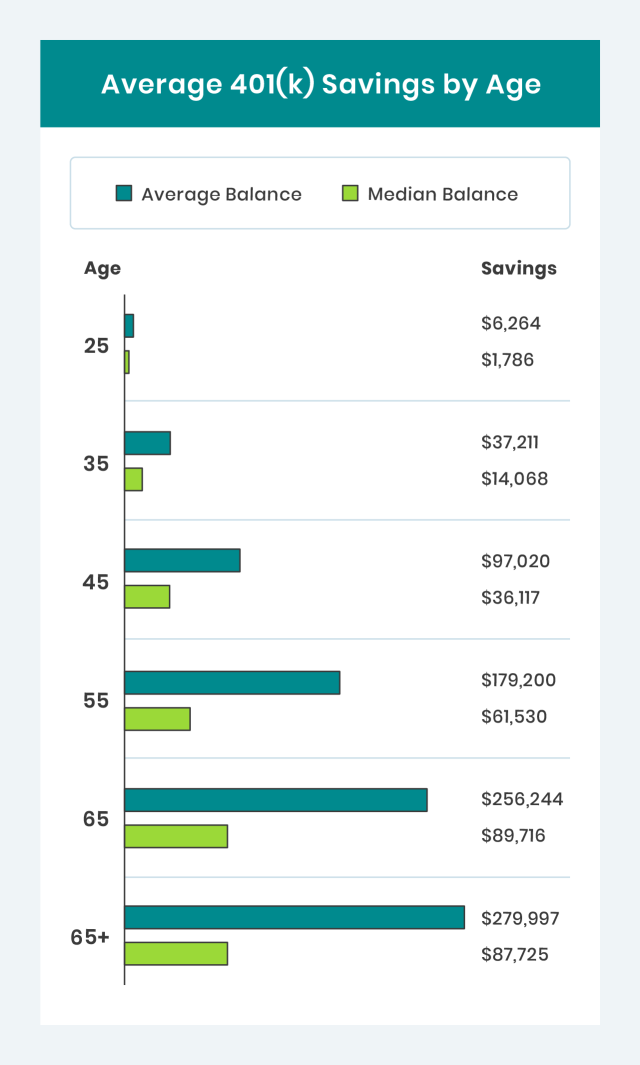

401k Savings By Age How Much Should You Save For Retirement

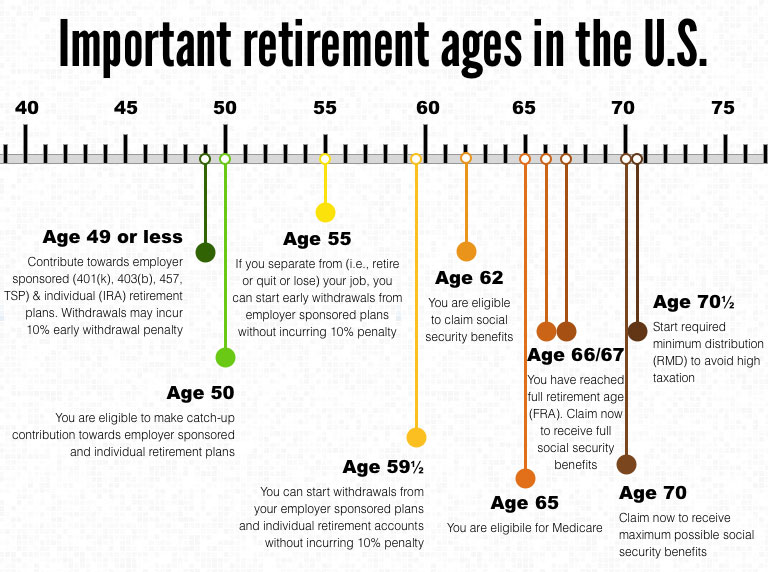

Important ages for retirement savings, benefits and withdrawals 401k

The Surprising Average 401k Plan Balance By Age

How To Take Early 401k Withdrawal Without Penalty DON'T Rollover

401k balance by age 2022 Inflation Protection

Average 401(k) Balance by Age Your Retirement Timeline

Generally, If You Withdraw Money From A 401 (K) Before The Plan’s Normal Retirement Age Or From An Ira Before Turning 59 ½, You’ll Pay An.

Web The Irs Rule Of 55 Recognizes You Might Leave Or Lose Your Job Before You Reach Age 59½.

You Can't Take Loans From Old 401(K) Accounts.

The Good News Is That There’s A Way To Take Your Distributions A Few Years Early Without Incurring This Penalty.

Related Post: