Age To Draw 401K

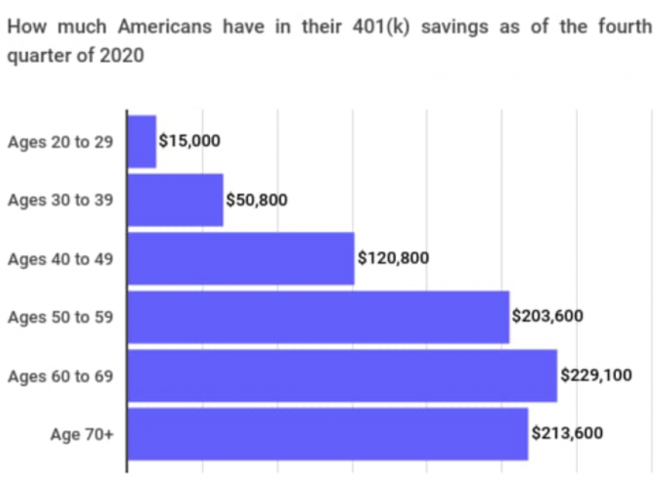

Age To Draw 401K - Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. You can't take loans from old 401(k) accounts. Explore all your options for getting cash before tapping your 401 (k) savings. Iras (including seps and simple iras) april 1 of the year following the calendar year in which you reach age 72 (73 if you reach age 72 after dec. Web those who contribute to workplace 401 (k)s must know the rules for 401 (k) required minimum distributions, or rmds, since rmd rules mandate that accountholders begin withdrawing money at. This is known as the rule of 55. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web first, let’s recap: (these are called required minimum distributions, or rmds). In most, but not all, circumstances, this triggers an early withdrawal penalty of. 1 if you will turn 72 after jan. Web understanding early withdrawals. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Generally, april 1 following the later of the calendar year in which you: If you delay taking your benefits from your full retirement. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10%. Web updated february 09, 2024. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Have left your employer voluntarily or involuntarily in the year. Web you can start receiving your social security retirement benefits as early as age 62. Web to use the rule of 55, you’ll need to: Web updated february 09, 2024. Web understanding early withdrawals. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Web in your 60s: Have left your employer voluntarily or involuntarily in the year. Web first, let’s recap: Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. You can't take loans from old 401(k) accounts. Web updated february 09, 2024. If you’re contemplating early retirement, you should know how the rule of 55 works. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. (these are called required minimum distributions, or rmds). Have left your employer voluntarily or involuntarily in the year. Web you reach age 59½ or experience a financial hardship. Every. The approximate amount you will clear on a $10,000 withdrawal from a 401 (k) if you are under age 59½ and subject to a 10% penalty and taxes. Web required minimum distribution calculator. You can't take loans from old 401(k) accounts. Web you’re age 55 to 59 ½. Web first, let’s recap: Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. This is known as the rule of 55. Web in your 60s: The good news is that there’s a way to take your distributions a few years. Web you’re age 55 to 59 ½. Web chris gentry has been saving diligently for retirement but is concerned about fees in his 401 (k). Several key retirement decisions come during this decade. In certain circumstances, the plan administrator must obtain your consent before making a distribution. You can't take loans from old 401(k) accounts. Several key retirement decisions come during this decade. This is known as the rule of 55. If you delay taking your benefits from your full retirement age. Web understanding early withdrawals. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Be at least age 55 or older. Web when it comes to when you can withdraw 401(k) funds, age 59½ is the magic number. Have left your employer voluntarily or involuntarily in the year. In most, but not all, circumstances, this triggers an early withdrawal penalty of. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Web those who contribute to workplace 401 (k)s must know the rules for 401 (k) required minimum distributions, or rmds, since rmd rules mandate that accountholders begin withdrawing money at. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Web you’re age 55 to 59 ½. In certain circumstances, the plan administrator must obtain your consent before making a distribution. Web you reach age 59½ or experience a financial hardship. Researchers found that although it's the least popular time to file (with only 4% of retirees filing at that age), around 57% of the study participants could have earned more over a. Web you can start receiving your social security retirement benefits as early as age 62. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Use our required minimum distribution (rmd) calculator to determine how much money you need to take out of your traditional ira or 401 (k) account this year.

401k By Age PreTax Savings Goals For Retirement Financial Samurai

401k Savings By Age How Much Should You Save For Retirement

401k balance by age 2022 Inflation Protection

401k Savings By Age How Much Should You Save For Retirement

Retirement Savings By Age How Does Your 401K Balance Stack Up?

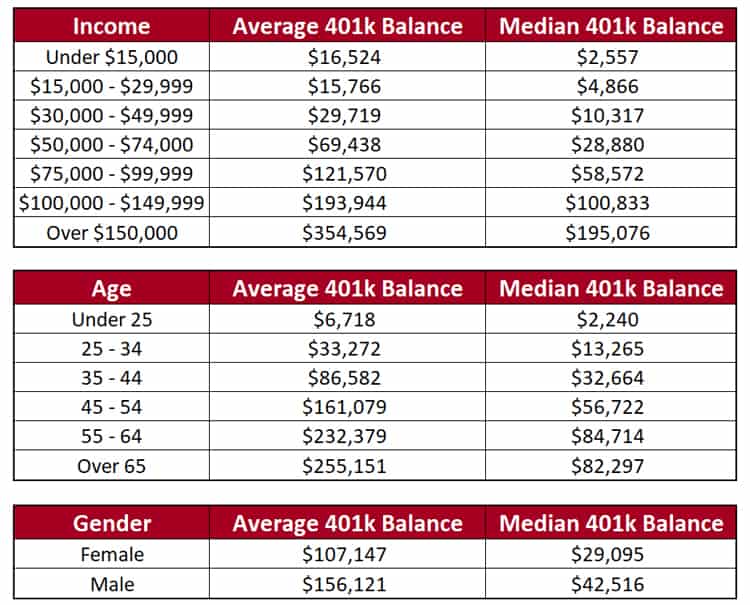

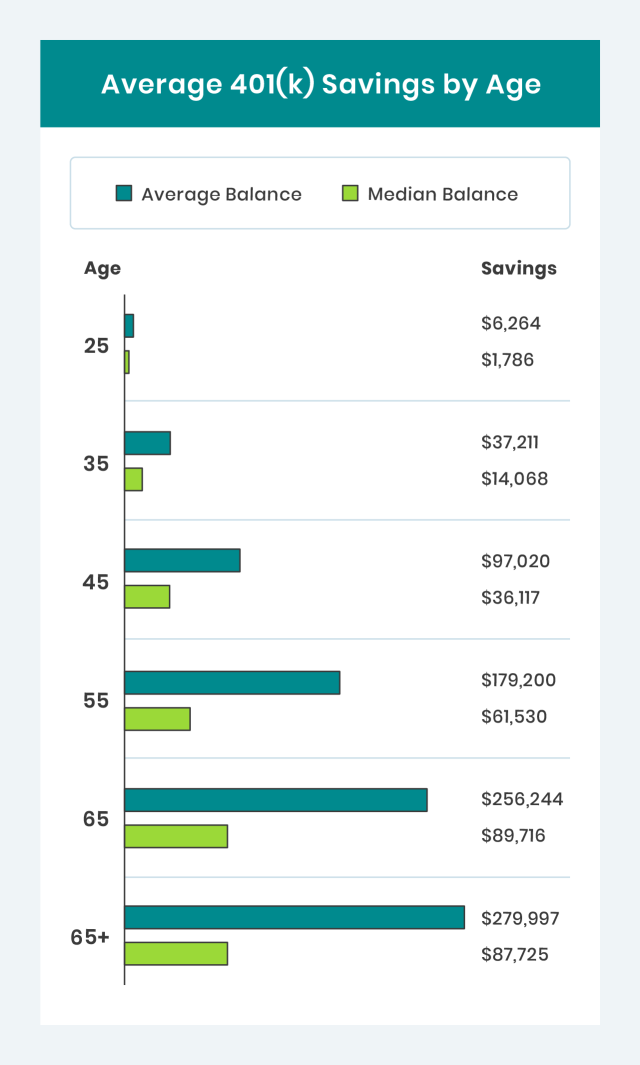

The Surprising Average 401k Plan Balance By Age

What is the Average 401k Balance by Age? (See How You Compare) Dollar

The Average And Median 401(k) Account Balance By Age

Average 401(k) Balance by Age Your Retirement Timeline

The Rise Of 401k Millionaires Living Large In Retirement

The Approximate Amount You Will Clear On A $10,000 Withdrawal From A 401 (K) If You Are Under Age 59½ And Subject To A 10% Penalty And Taxes.

The Costs Of Early 401 (K) Withdrawals.

However, You Are Entitled To Full Benefits When You Reach Your Full Retirement Age.

Early Withdrawals Occur If You Receive Money From A 401 (K) Before Age 59 1/2.

Related Post: